LEG reported a net profit after tax of 2.4 million Pounds, or an equivalent of 0.1 pence, itself a record.

Total investments increased by 231%, while assets and net assets grew 205% and 201% respectively.

Much of the value was driven by Virtual Stock (VS)/ VS valuation more than doubled to 58 million Pounds for the period. LEG's stake in VS now values 4.1 million Pounds.

Elsewhere, Amedeo Resources completed building its first rig while Bosques generation one and two pongamia had germinated and were producing saplings. Bosques is expected to benefit from the climate change accord achieved in Paris.

LEG has also acquired a 5.5% stake and an option over an additional 4.5% stake in Manas resources, a gold exploration company. While the price of gold has fallen in the last 3 years, a potential global debt crisis could see a revival in the demand for the precious metal.

LEG is very much a long term play. I still see the eventual listing of VS as a potential catalyst which could see LEG rising more than 300%. in the next 2 -3 years. Based on its net profit and stake's value in VS, LEG is indeed undervalued. However, investing in the UK AIM carries with it high risks and you are advised to do your own due diligence.

My disclosure: I own shares in LEG

Use of information contained in this blog does not constitute any contractual relationship between the reader and the author. The author hereby disclaims all responsibilities and liabilities for any use of information contained in this blog. Readers are advised to exercise due diligence and do their own assessment of the risks involved when investing in any company. Readers shall not hold the author liable for investments which have gone sour.

Thursday, December 31, 2015

2015 HAS ENDED. WHAT LIES AHEAD IN 2016?

2015 came and gone. There were some ups but there were many downs as well. It anything, 2015 lay the foundations for a crises ridden year ahead.

To recap, 2015 saw the following:

1) The Fed raised its first interest rates in almost a decade. However, this was against a backdrop of a worsening economy. Just as recently, the Chicago PMI fell to a worrisome 42.9, way below the expected 50.

2) The US government finally lifted the ban on oil export.

3) Depressed commodity prices, especially oil which threaten to unravel the debt market with defaults.

3) Towards the end of the year, we saw unprecedented sell off of high yield bond funds

4) The Baltic Index continue to test its lowest lows

5) Precious metals continued their third year of decline despite central banks and retail investors buying

6) The Dow and S&P fell 2.2% and 0.9% respectively in 2015 while the NASDAQ was up 5.7%. The broader Russell 2000 fell 5.7% for the year.

7) US$ stayed strong while other currencies, especially emerging economy currencies fell.

8) Major economies such as Brazil, Canada and Russia fell into recession. If anything, EU and Japan failed to inspire despite the QE implemented while China looked set to have a hard landing

9) Geopolitical tension rose to a new high in the Middle East and spilled over into the EU as terrorists became a clear and present threat.

Yes, the sequence of events leading to 2016 do not look too bright I am afraid. In the immediate future we could likely see the following:

1) Further distress in the shale oil industry which could cause a series of defaults

2) Unraveling of high yield bonds which could threaten the financial derivatives market

3) Q4 2015 could see earnings drop in many companies in the S&P 500 due to a host of issues, such as a strong US$, heavy debts and a worsening manufacturing sector

4) Further defaults are expected in China due to worsening economic situation and lower revenue from exports.

5) A US debt which could spiral out of control which could push the government 's debt past US$20 trillion (as at end of December 2015 the debt stood at US$18,8 trillion). On top of that, the debt levels of EU nations, Japan, China and emerging economies continue to rise.

6) All the above will culminate in a full blown global debt crisis which

7) Geopolitical tension could turn for the worse, with an impending war involving nations

Certainly it makes good sense to take profit now while the stock market still hovers at near record levels. Retain some cash, while diversifying your portfolio into gold and silver mining stocks, gold and silver ETFs, and ETFs which short the markets (do need to exercise care in short ETFs as the Fed may surprise with a QE4. The other option is to invest directly in physical god and silver.

To recap, 2015 saw the following:

1) The Fed raised its first interest rates in almost a decade. However, this was against a backdrop of a worsening economy. Just as recently, the Chicago PMI fell to a worrisome 42.9, way below the expected 50.

2) The US government finally lifted the ban on oil export.

3) Depressed commodity prices, especially oil which threaten to unravel the debt market with defaults.

3) Towards the end of the year, we saw unprecedented sell off of high yield bond funds

4) The Baltic Index continue to test its lowest lows

5) Precious metals continued their third year of decline despite central banks and retail investors buying

6) The Dow and S&P fell 2.2% and 0.9% respectively in 2015 while the NASDAQ was up 5.7%. The broader Russell 2000 fell 5.7% for the year.

7) US$ stayed strong while other currencies, especially emerging economy currencies fell.

8) Major economies such as Brazil, Canada and Russia fell into recession. If anything, EU and Japan failed to inspire despite the QE implemented while China looked set to have a hard landing

9) Geopolitical tension rose to a new high in the Middle East and spilled over into the EU as terrorists became a clear and present threat.

Yes, the sequence of events leading to 2016 do not look too bright I am afraid. In the immediate future we could likely see the following:

1) Further distress in the shale oil industry which could cause a series of defaults

2) Unraveling of high yield bonds which could threaten the financial derivatives market

3) Q4 2015 could see earnings drop in many companies in the S&P 500 due to a host of issues, such as a strong US$, heavy debts and a worsening manufacturing sector

4) Further defaults are expected in China due to worsening economic situation and lower revenue from exports.

5) A US debt which could spiral out of control which could push the government 's debt past US$20 trillion (as at end of December 2015 the debt stood at US$18,8 trillion). On top of that, the debt levels of EU nations, Japan, China and emerging economies continue to rise.

6) All the above will culminate in a full blown global debt crisis which

7) Geopolitical tension could turn for the worse, with an impending war involving nations

Certainly it makes good sense to take profit now while the stock market still hovers at near record levels. Retain some cash, while diversifying your portfolio into gold and silver mining stocks, gold and silver ETFs, and ETFs which short the markets (do need to exercise care in short ETFs as the Fed may surprise with a QE4. The other option is to invest directly in physical god and silver.

Monday, December 21, 2015

LEGENDARY INVESTMENT UPDATE

Legendary Investment (LEG) recently announced that Virtualstock (VS) has appointed Robert Knott, formerly National Director of NHS Procurement as Director of Healthcare and Public Sector.

As you may well remember LEG holds a 7% stake in VS. VS had in July, 2015 entered into contract with NHS Teaching Hospital Trust.

I see this as a good progress and hope to see more contracts signed with NHS covering wider areas of procurement and distribution.

LEG has always been in the 0.08 - 0.09 pence range, but we are seeing a lot more consistencies in the 0.11 - 0.14 range.

LEG is still a good buy and hold story provided you have a wider time frame; ie: 3 - 5 years.

My disclosure: I own shares of LEG

Saturday, December 19, 2015

PPHM Q2 RESULTS

PPHM recently announced their Q2 results:

1) The Sunrise Phase 3 Trial is now more than 90% enrolled, which put it in line for a first look-in, possibly in Q1 2016 and a second look-in in mid 2016. final unblinding of results could take place in late 2016.

2) The Phase 2/3 Trial for breast cancer is expected to start at the end of 2015, while the Phase 2 Trial lung cancer trail combining Bavituximab and AZN's Durvalumad could start in early 2016.

3) Phase 1 Trials combining Bavituximab and Durvalumab for multiple tumours are expected to start later in 2016.

4) Avid Bioservices recorded a revenue growth of 52% in Q2 this year vs Q2 last year. YTD revenue increased 61% vs last year.

5) Current backlog of order have reached US$49 million. PPHM increased its revenue forecast in the current financial year to US$35 million - US$40 million from US$30 million - US$35 million previously.

6) The new manufacturing facility is finally ready to commence manufacturing. Armed with state of the art equipment, the new facility could easily double Avid Bioservices capacity. It has the potential to generate another US$40 million revenue once manufacturing goes into full swing.

2016 could be the defining year for PPHM. Increasingly, many medical professionals and researchers are acknowledging the role PS in blocking our immune system from functioning effectively. And Bavituximab stands as the only PS targeting drug with the capability to counter-react against PS. I see a bright future ahead.

My disclosure: I own shares of PPHM.

1) The Sunrise Phase 3 Trial is now more than 90% enrolled, which put it in line for a first look-in, possibly in Q1 2016 and a second look-in in mid 2016. final unblinding of results could take place in late 2016.

2) The Phase 2/3 Trial for breast cancer is expected to start at the end of 2015, while the Phase 2 Trial lung cancer trail combining Bavituximab and AZN's Durvalumad could start in early 2016.

3) Phase 1 Trials combining Bavituximab and Durvalumab for multiple tumours are expected to start later in 2016.

4) Avid Bioservices recorded a revenue growth of 52% in Q2 this year vs Q2 last year. YTD revenue increased 61% vs last year.

5) Current backlog of order have reached US$49 million. PPHM increased its revenue forecast in the current financial year to US$35 million - US$40 million from US$30 million - US$35 million previously.

6) The new manufacturing facility is finally ready to commence manufacturing. Armed with state of the art equipment, the new facility could easily double Avid Bioservices capacity. It has the potential to generate another US$40 million revenue once manufacturing goes into full swing.

2016 could be the defining year for PPHM. Increasingly, many medical professionals and researchers are acknowledging the role PS in blocking our immune system from functioning effectively. And Bavituximab stands as the only PS targeting drug with the capability to counter-react against PS. I see a bright future ahead.

My disclosure: I own shares of PPHM.

Wednesday, December 16, 2015

FINALLY THE FED HAS DONE IT!

Finally the Fed has raised the interest rate by 25 basis point. The Fed even mentioned that unemployment numbers were good and the economy was sound. They even forecast a 25 basis point rate increase in every quarter in 2016. But nothing could be further than the truth. Here's why:

1) An interest rate hike will push the value of the US$ upwards. So prepare to see US trade deficit increase and US made goods more expensive. This will result in further manufacturing slowdown. The November PMI is just barely above the 50 level at 51.3 while the ISM manufacturing data showed a reading of 48.6. Incidentally the Chinese Yuan has continued to depreciate vs the US$. So I expect to see further reduction of imports from the US in China, thus widening the trade deficit.

2) Yes, jobs growth have been fantastic - but at the expense of manufacturing jobs. Low paying jobs in the services sector are substituting high paying manufacturing jobs. So the volume matters less as more people are earning less. This could impact consumption further down the road. The unemployment data exclude people who have left the work force or gave up on finding any employment. If these were taken into account, the number of unemployment could see as high as 9.9% (The U-6 data). The unemployment rate is actually far worse than the Fed perceives.

3) There was a sell off in High Yield Bonds with two funds (Third Avenue and Stone Lion) halting further redemptions which prompted Carl Ichan to warn that a meltdown is coming. In fact the performance of the majority of High Yield Bond funds are already in negative territory.

Most High Yield Bond funds invest in the depressed energy, mining and industrial sectors. The recent rate hike would put pressure on major shale oil producers as the cost of refinancing increases. Add in a depressed oil price and many could be in distress in coming weeks. A total of 44 shale oil producers are utlising 83 cents per dollar of cash flow to pay interests on debts. Should these companies fail it could threaten a combined US$200B - US$250B worth of debt held by shale oil companies. This could unravel the financial markets.

4) The US is sitting on a debt time bomb. Increase in interest rate just increase the burden of payment. The Total US debt stands at US$58T, more than 300% of its GDP. Global debt is about US$230T which is also more than 300% of global GDP. Since 2007, global debt has increased more than 200%. Total global financial derivatives stands at US$700T (lowest estimate) which is more than the US$506T total during the 2008 Global Financial Crisis.

So the unraveling of bonds could impact the financial derivatives market, which could result in a full blown crisis, much worse than the 2008 crisis

The interest rate hike would push many companies worldwide into default especially those from the EM which borrowed US$ to fund their expansion, as their currencies fall in value vs the US$.

And if you've not read about it, auto dealers are offering cheap loans to buyers, and many of the loans could be of sub prime quality. The total auto loans just exceeded US$1T.

5) Home sales. The Fed touted the increase in home sales as a strong indicator for the economy. Well let's see if there's any increase in home sales after the interest rate hike. More likely, buyers are rushing to commit before the interest rate hike.

6) S&P 500 companies are already in earning recession. In 2014 the S&P 500 companies borrowed more money to buy back shares and paid dividends than their earnings. The ratio: US$1.27 of debt vs US$1.00 of earnings. Yet the S&P is trading at multi year highs.

Even the NASDAQ big 4, the FANG are trading at astronomical values. Facebook is trading at a PE of 107.28, Amazon, a PE of 980.29, Netflix, a PE of 372.02, and Google, a PE of 35.66. Talk about high valuations! In fact the 4 have almost the same marketcap of the DAX 30 companies combined!

7) The Baltic Index just hit a record low at 471 due to the collapse of the price of commodities, compared that to its height of more than 10,000 in 2007- 2008. If the Baltic Index cannot be a good gauge of global trade then I do not know what is.

All the above points to a potential crash of epic proportions.

These are some of the things which you can do:

Look into ETFs that short the market indices. (Please do your own research). The pivot point will be in Q1 2016 during the earnings period and potential default in debt by major shale oil producers.

Invest in Gold and Silver ETFs and mining companies. (Please do your own research). The strength of the US$ will propel the price of Gold and Silver lower, making the investment cheap as a hedge. Interestingly, Goldman and HSBC who were both bearish on Gold, bought more than 7 tons of the metal in August, 2015. China, Russia and India continue to accumulate Gold. Now, if it is such a bad investment why are the bankers and central bankers buying? Look at the COMEX. Amount of Gold sold is leveraged more than 300 to 1 physical ounce of Gold.

Buy physical Gold and Silver. Invest in other hard assets such as land.

The above are entirely my opinion. Always remember to do your own research.

1) An interest rate hike will push the value of the US$ upwards. So prepare to see US trade deficit increase and US made goods more expensive. This will result in further manufacturing slowdown. The November PMI is just barely above the 50 level at 51.3 while the ISM manufacturing data showed a reading of 48.6. Incidentally the Chinese Yuan has continued to depreciate vs the US$. So I expect to see further reduction of imports from the US in China, thus widening the trade deficit.

2) Yes, jobs growth have been fantastic - but at the expense of manufacturing jobs. Low paying jobs in the services sector are substituting high paying manufacturing jobs. So the volume matters less as more people are earning less. This could impact consumption further down the road. The unemployment data exclude people who have left the work force or gave up on finding any employment. If these were taken into account, the number of unemployment could see as high as 9.9% (The U-6 data). The unemployment rate is actually far worse than the Fed perceives.

3) There was a sell off in High Yield Bonds with two funds (Third Avenue and Stone Lion) halting further redemptions which prompted Carl Ichan to warn that a meltdown is coming. In fact the performance of the majority of High Yield Bond funds are already in negative territory.

Most High Yield Bond funds invest in the depressed energy, mining and industrial sectors. The recent rate hike would put pressure on major shale oil producers as the cost of refinancing increases. Add in a depressed oil price and many could be in distress in coming weeks. A total of 44 shale oil producers are utlising 83 cents per dollar of cash flow to pay interests on debts. Should these companies fail it could threaten a combined US$200B - US$250B worth of debt held by shale oil companies. This could unravel the financial markets.

4) The US is sitting on a debt time bomb. Increase in interest rate just increase the burden of payment. The Total US debt stands at US$58T, more than 300% of its GDP. Global debt is about US$230T which is also more than 300% of global GDP. Since 2007, global debt has increased more than 200%. Total global financial derivatives stands at US$700T (lowest estimate) which is more than the US$506T total during the 2008 Global Financial Crisis.

So the unraveling of bonds could impact the financial derivatives market, which could result in a full blown crisis, much worse than the 2008 crisis

The interest rate hike would push many companies worldwide into default especially those from the EM which borrowed US$ to fund their expansion, as their currencies fall in value vs the US$.

And if you've not read about it, auto dealers are offering cheap loans to buyers, and many of the loans could be of sub prime quality. The total auto loans just exceeded US$1T.

5) Home sales. The Fed touted the increase in home sales as a strong indicator for the economy. Well let's see if there's any increase in home sales after the interest rate hike. More likely, buyers are rushing to commit before the interest rate hike.

6) S&P 500 companies are already in earning recession. In 2014 the S&P 500 companies borrowed more money to buy back shares and paid dividends than their earnings. The ratio: US$1.27 of debt vs US$1.00 of earnings. Yet the S&P is trading at multi year highs.

Even the NASDAQ big 4, the FANG are trading at astronomical values. Facebook is trading at a PE of 107.28, Amazon, a PE of 980.29, Netflix, a PE of 372.02, and Google, a PE of 35.66. Talk about high valuations! In fact the 4 have almost the same marketcap of the DAX 30 companies combined!

7) The Baltic Index just hit a record low at 471 due to the collapse of the price of commodities, compared that to its height of more than 10,000 in 2007- 2008. If the Baltic Index cannot be a good gauge of global trade then I do not know what is.

All the above points to a potential crash of epic proportions.

These are some of the things which you can do:

Look into ETFs that short the market indices. (Please do your own research). The pivot point will be in Q1 2016 during the earnings period and potential default in debt by major shale oil producers.

Invest in Gold and Silver ETFs and mining companies. (Please do your own research). The strength of the US$ will propel the price of Gold and Silver lower, making the investment cheap as a hedge. Interestingly, Goldman and HSBC who were both bearish on Gold, bought more than 7 tons of the metal in August, 2015. China, Russia and India continue to accumulate Gold. Now, if it is such a bad investment why are the bankers and central bankers buying? Look at the COMEX. Amount of Gold sold is leveraged more than 300 to 1 physical ounce of Gold.

Buy physical Gold and Silver. Invest in other hard assets such as land.

The above are entirely my opinion. Always remember to do your own research.

Saturday, December 5, 2015

WITH NOVEMBER NFP EXCEEDING EXPECTATIONS A RATE HIKE IN DECEMBER LOOKS SET

Well, with November Non-Farm Payroll exceeding expectations at 211,000 jobs, and a revision in October that was higher than the previous; ie 298,000 jobs vs 271,000 prior, it looks set that the Federal Reserve will raise its first interest rate in almost a decade in December.

This is against a background of an ISM Manufacturing Index that fell below 50 in November at 48.6, which is a signal of a contraction, an escalating debt in the US which totaled more than US$58T (government, corporations and households), and a widening trade deficit, due to the continued strength of the US$.

What will be the impact on various sectors of the economy? What about the global economy?

Below are my summation of what could happen in the next few months:

1) US$ Index could go higher amidst QE in EU and Japan, and interest rates easing in many countries in Asia. This could further impact US exports and US trade deficit could grow wider

2) A stronger US$ could impact earnings of multi nationals in terms of US$. This could push the earning of major multinational in the S&P 500 companies into negative growth territory, It seems likely that the S&P 500 could see its earnings recession being extended for the next two quarters as global economy continue to deteriorate. And don't forget, the S&P 500 companies took in more debts than ever for dividends and share buybacks in the last few years. So earnings will be squeezed on both fronts

3) The burden of debt repayment will increase throughout the world, especially for governments and corporations in emerging markets which borrowed in US$. Coupled with the depreciation in the local currencies, many could see their budget stretched. In fact, it is anticipated that China which has US$16T in corporate debts, could face a string of defaults. So far 6 major corporations have failed to meet interest payments on their respective bonds and another 5 have been identified as potentially missing their interest payments in the coming months.

On the US front, the biggest threat would be the default by US shale oil companies which could potentially put US$250B worth of bonds at risk. According to the EIA, some 44 shale oil companies use $0.83 of every US$1.00 they took in to pay off their debt commitments. And herein lies the danger of default as OPEC failed to reach an agreement to lower production in their meeting in Vienna on December 4, which immediately sent oil price further south. Increase in interest rate will only burden these companies as refinancing becomes more expensive and private equity funds shun further investments.

4) REITs which rely on debts to fund acquisitions could find borrowing costs higher and thus impact upon the distributable income to unit holders

5) What of the US government's US$18T? Already tax revenue is falling short of expenditure. Will increase in interest rate result in more borrowings in order to pay off the ever increasing debt level?

In my opinion, despite the assurance by the Federal Reserve, I tend to agree with Citibank's assessment that global recession risks have just increased. This will be followed by a debt crisis of epic proportions which could make the 2008 Financial Crisis seem like child's play.

This is against a background of an ISM Manufacturing Index that fell below 50 in November at 48.6, which is a signal of a contraction, an escalating debt in the US which totaled more than US$58T (government, corporations and households), and a widening trade deficit, due to the continued strength of the US$.

What will be the impact on various sectors of the economy? What about the global economy?

Below are my summation of what could happen in the next few months:

1) US$ Index could go higher amidst QE in EU and Japan, and interest rates easing in many countries in Asia. This could further impact US exports and US trade deficit could grow wider

2) A stronger US$ could impact earnings of multi nationals in terms of US$. This could push the earning of major multinational in the S&P 500 companies into negative growth territory, It seems likely that the S&P 500 could see its earnings recession being extended for the next two quarters as global economy continue to deteriorate. And don't forget, the S&P 500 companies took in more debts than ever for dividends and share buybacks in the last few years. So earnings will be squeezed on both fronts

3) The burden of debt repayment will increase throughout the world, especially for governments and corporations in emerging markets which borrowed in US$. Coupled with the depreciation in the local currencies, many could see their budget stretched. In fact, it is anticipated that China which has US$16T in corporate debts, could face a string of defaults. So far 6 major corporations have failed to meet interest payments on their respective bonds and another 5 have been identified as potentially missing their interest payments in the coming months.

On the US front, the biggest threat would be the default by US shale oil companies which could potentially put US$250B worth of bonds at risk. According to the EIA, some 44 shale oil companies use $0.83 of every US$1.00 they took in to pay off their debt commitments. And herein lies the danger of default as OPEC failed to reach an agreement to lower production in their meeting in Vienna on December 4, which immediately sent oil price further south. Increase in interest rate will only burden these companies as refinancing becomes more expensive and private equity funds shun further investments.

4) REITs which rely on debts to fund acquisitions could find borrowing costs higher and thus impact upon the distributable income to unit holders

5) What of the US government's US$18T? Already tax revenue is falling short of expenditure. Will increase in interest rate result in more borrowings in order to pay off the ever increasing debt level?

In my opinion, despite the assurance by the Federal Reserve, I tend to agree with Citibank's assessment that global recession risks have just increased. This will be followed by a debt crisis of epic proportions which could make the 2008 Financial Crisis seem like child's play.

Tuesday, December 1, 2015

FEDERAL RESERVE JUST HAVE A TOUGHER DECISION ON INTEREST RATE HIKE

Two interesting developments:

US ISM Manufacturing Index fell to 48.6 last night

Atlanta Federal reserve cuts its Q4 US GDP growth rate to 1.4% from 1.8%

A manufacturing index below 50 means contraction. This could put pressure on the Federal Reserve to have a modest hike in interest rate in December or none at all.

If no hike, then Emerging markets will breathe a sigh of relief.

But... if could mean kicking the can further down the road.

US TOTAL DEBT NOW: US$18.827T!

In a report by ZeroHedge, US public debt has reached an unprecedented US$18.827T!

According to the report, it just 4 weeks, the US has accumulated a total of US$674B in just November alone!

Now for those who articulated that US will start a tightening cycle with interest rates increase every quarter, you better think again.

How can further increase in interest rates help improve the US debt payment and lower its debt burden?

It is a global economy where all the economies of the world are interconnected. How can the US economy power ahead amidst an interest rates increase, by claiming that the US economy is fully decoupled from the rest of the world?

Won't an increase in interest rates cause the US$ to spike further thereby hurting the exports of US made goods? Widen the trade deficit? Impose burden of debt among US corporations which went on a borrowing binge during the last few years? Affect US companies earnings and therefore future job growth?

To know that these are the high flying economists and analysts of big banks and financial institutions - is indeed a sad reflection of their poor acknowledgement of fundamentals.

And for all the shortfall, it is always easy to blame the Federal Reserve for failing to stop QE, but what about the banks and financial institutions and corporations' disproportionate increase in leverage relative to their earnings? The Federal Reserve has to shoulder some of the blame, but so must the greedy corporations too, in regard to the failure of QE.

The above is just my opinion.

According to the report, it just 4 weeks, the US has accumulated a total of US$674B in just November alone!

Now for those who articulated that US will start a tightening cycle with interest rates increase every quarter, you better think again.

How can further increase in interest rates help improve the US debt payment and lower its debt burden?

It is a global economy where all the economies of the world are interconnected. How can the US economy power ahead amidst an interest rates increase, by claiming that the US economy is fully decoupled from the rest of the world?

Won't an increase in interest rates cause the US$ to spike further thereby hurting the exports of US made goods? Widen the trade deficit? Impose burden of debt among US corporations which went on a borrowing binge during the last few years? Affect US companies earnings and therefore future job growth?

To know that these are the high flying economists and analysts of big banks and financial institutions - is indeed a sad reflection of their poor acknowledgement of fundamentals.

And for all the shortfall, it is always easy to blame the Federal Reserve for failing to stop QE, but what about the banks and financial institutions and corporations' disproportionate increase in leverage relative to their earnings? The Federal Reserve has to shoulder some of the blame, but so must the greedy corporations too, in regard to the failure of QE.

The above is just my opinion.

Sunday, November 29, 2015

HAS GOLD LOST ITS SHINE?

According to the media, the expectations that the Federal Reserve would raise interest rate is pushing commodities down due to the rising value of the US$.

We have economists and analysts saying that this is the beginning of a tightening cycle. Gold has lost its shine as it does not earn its investors any dividends or interest.

We have Goldman Sachs predicting that the Federal Reserve will raise its rate in December followed by a 100 basis point increase in 2016 and gold will fall to US$1,000 per oz.

Some even predicted that gold will fall below $1,000 per oz in 2016. The bearish signals are rather overwhelming.

Then incredibly, on 10 August, Speaking Alpha reported that on 6 August, Goldman Sachs bought 3.2 tons of gold while HSBC bought 3.9 tons. Both purchases were recorded as being for the benefit of the banks' own house account.

It leads one to wonder why the bearish call from Goldman Sachs when they are urging traders to sell gold. Reminds me of the CDOs fiasco back in the 2007-2008 period.

Incidentally, while traders have been most bearish on gold, Russia and China have been steadily accumulating as well. Now if gold is going to be worthless, one also wonders why the central bank of both countries are buying gold.

Link http://www.bloomberg.com/news/articles/2015-10-22/fed-getting-started-on-rates-will-hurt-bullion-goldman-predicts

Link: http://seekingalpha.com/article/3421396-the-big-long-goldman-sachs-and-hsbc-buy-7_1-tons-of-physical-gold

We have economists and analysts saying that this is the beginning of a tightening cycle. Gold has lost its shine as it does not earn its investors any dividends or interest.

We have Goldman Sachs predicting that the Federal Reserve will raise its rate in December followed by a 100 basis point increase in 2016 and gold will fall to US$1,000 per oz.

Some even predicted that gold will fall below $1,000 per oz in 2016. The bearish signals are rather overwhelming.

Then incredibly, on 10 August, Speaking Alpha reported that on 6 August, Goldman Sachs bought 3.2 tons of gold while HSBC bought 3.9 tons. Both purchases were recorded as being for the benefit of the banks' own house account.

It leads one to wonder why the bearish call from Goldman Sachs when they are urging traders to sell gold. Reminds me of the CDOs fiasco back in the 2007-2008 period.

Incidentally, while traders have been most bearish on gold, Russia and China have been steadily accumulating as well. Now if gold is going to be worthless, one also wonders why the central bank of both countries are buying gold.

Link http://www.bloomberg.com/news/articles/2015-10-22/fed-getting-started-on-rates-will-hurt-bullion-goldman-predicts

Link: http://seekingalpha.com/article/3421396-the-big-long-goldman-sachs-and-hsbc-buy-7_1-tons-of-physical-gold

Friday, November 27, 2015

LGO UPDATE

LGO announced that it has reached an agreement with BNP Paribas to terminate the prepaid swap at its current value of US10.8M including all future interests and fees.

LGo will have a schedule of repayments, starting with the next three months (December 2015 - February 2016) at a reduced rate of US$75,000 per month, after which the remaining outstanding balance will be recovered over the following 19 months at at rate of approximately 5% per month.

LGO and BNP will continue to have regular constructive discussions aime d at assisting LG to establish a secure and sustainable platform for future investment.

Meanwhile, LGO is working closely with its US advisors, Wellford capital markets and height Securities ons trategic investments in the business. LGO expects to be actively discussing with potential investments with clients of Wellford and Height in the next two months.

The agreement reached with BNP is pivotal to LGo to maintain the momentum in their oil production operations in Trinidad.

My disclosure: I own shares of LGO

LGo will have a schedule of repayments, starting with the next three months (December 2015 - February 2016) at a reduced rate of US$75,000 per month, after which the remaining outstanding balance will be recovered over the following 19 months at at rate of approximately 5% per month.

LGO and BNP will continue to have regular constructive discussions aime d at assisting LG to establish a secure and sustainable platform for future investment.

Meanwhile, LGO is working closely with its US advisors, Wellford capital markets and height Securities ons trategic investments in the business. LGO expects to be actively discussing with potential investments with clients of Wellford and Height in the next two months.

The agreement reached with BNP is pivotal to LGo to maintain the momentum in their oil production operations in Trinidad.

My disclosure: I own shares of LGO

CHINA'S YUAN IS DEPRECIATING AGAIN

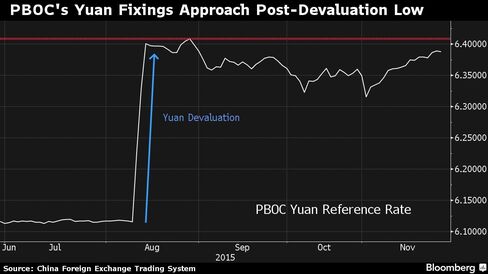

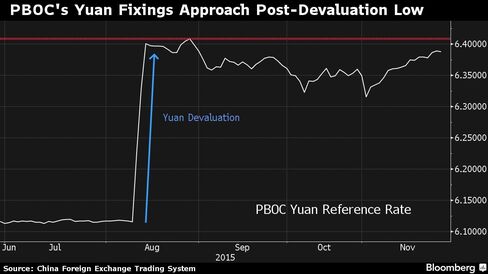

China's Yuan is almost back to its devaluation level in August. And I think China's troubles are just beginning.

From Bloomberg website

China has a huge debt problem, almost 300% of its GDP, over capacity in state owned heavy industries such as copper, aluminium and steel. Only as recently, it was reported in the news that many are asking the government to absorb their excess capacity. Several are in default of their debt obligations. Here are some examples in 2015:

1) Kaisa Group interest default (US$52M)

2) Baoding Tianwei Group Co interest default (85.8M Yuan)

3) Sinosteel default on 5.3% interest on 2B Yuan notes

4) Winsay Enterprises Holdings failed to meet interest payment on US$ notes for a second time this year

5) Yunan Coal Chemical Industry Group has 1.31B Yuan of overdue loans

6) Shanshui Cement announced on November 5 that it could default on its interest payment

I am expecting more defaults to come by early next year as manufacturing continues to contract. China's PMI has fallen below 50 for the past few months. 50 signals expansion while below 50 signals contraction. This is amidst a wave falling exports which crimped revenue in the manufacturing sector.

It is best to stay off any investment in China, and that include mainland Chinese stocks, bonds and currency. The worst is yet to come. If you should invest in China, go for companies listed in the US or HK instead, but only companies with very strong balance sheets.

From Bloomberg website

China has a huge debt problem, almost 300% of its GDP, over capacity in state owned heavy industries such as copper, aluminium and steel. Only as recently, it was reported in the news that many are asking the government to absorb their excess capacity. Several are in default of their debt obligations. Here are some examples in 2015:

1) Kaisa Group interest default (US$52M)

2) Baoding Tianwei Group Co interest default (85.8M Yuan)

3) Sinosteel default on 5.3% interest on 2B Yuan notes

4) Winsay Enterprises Holdings failed to meet interest payment on US$ notes for a second time this year

5) Yunan Coal Chemical Industry Group has 1.31B Yuan of overdue loans

6) Shanshui Cement announced on November 5 that it could default on its interest payment

I am expecting more defaults to come by early next year as manufacturing continues to contract. China's PMI has fallen below 50 for the past few months. 50 signals expansion while below 50 signals contraction. This is amidst a wave falling exports which crimped revenue in the manufacturing sector.

It is best to stay off any investment in China, and that include mainland Chinese stocks, bonds and currency. The worst is yet to come. If you should invest in China, go for companies listed in the US or HK instead, but only companies with very strong balance sheets.

Tuesday, November 24, 2015

GLOBAL DEBT HAS REACHED US$230T.

Global debt has reached US$230T whcih is 313% of the gloabl annual GDP. Financial derivatives market itself is worth some US$700T!

So who thinks the federal reserve will continue to raise rates?

There could be a Q4 sooner than we think.

Link: http://www.mybudget360.com/global-debt-total-amount-of-debt-world-gdp-to-debt-ratios/

So who thinks the federal reserve will continue to raise rates?

There could be a Q4 sooner than we think.

Link: http://www.mybudget360.com/global-debt-total-amount-of-debt-world-gdp-to-debt-ratios/

Monday, November 23, 2015

US OIL RIGS COUNT FELL 10 FOR WEEK ENDING 20 NOVEMBER, 2015

US oil rigs count fell by 10 for the week ending 20 November, 2015. Despite the drop in oil rigs count, oil price remained in the US$40 - US$42 range.

Oil price could potentially fall below US$40 in the near term as the glut in supply refuses to give way. This could put many US shale oil companies in jeopardy of defaulting on their heavy debt loads. Re-financing options are thin as many investors and private equity funds got burned, investing billions of dollars in US shale oil companies in spring, believing that oil price would recover towards the end of the year.

As early as Q1 2016 we could witness another round of bankruptcies.

The ball is very much in OPEC's court as many members are facing a squeeze on budget and many more could see their sovereign wealth funds deplete to troublesome levels should oil price fall into the US$30s range.

A proclamation of war on US shale oil has reached a level where there will be no winners but all could wind up as losers.

Oil price could potentially fall below US$40 in the near term as the glut in supply refuses to give way. This could put many US shale oil companies in jeopardy of defaulting on their heavy debt loads. Re-financing options are thin as many investors and private equity funds got burned, investing billions of dollars in US shale oil companies in spring, believing that oil price would recover towards the end of the year.

As early as Q1 2016 we could witness another round of bankruptcies.

The ball is very much in OPEC's court as many members are facing a squeeze on budget and many more could see their sovereign wealth funds deplete to troublesome levels should oil price fall into the US$30s range.

A proclamation of war on US shale oil has reached a level where there will be no winners but all could wind up as losers.

Sunday, November 22, 2015

DOLLAR INDEX BRIEFLY TOUCHED 100

The Dollar Index briefly touched 100 this morning. In view of its momentum, it could well go above that mark in expectation of the Federal Reserve hiking the US interest rate for the first time in almost a decade.

Many economists are predicting in a 25 - 50 basis point increase in December while some said it could be a gradual 25 basis point increase every quarter in 2016.

I think there could be a possible rate hike in December but after that, the Federal Reserve will be done raising interest rate. I don't think there will be any rate increase in 2016.

The global economic indicators and risks do not support further rate increases.

1) EU, Japan and China will continue their easing policies. This will make US goods more expensive and likely widen the trade deficit between US and the rest of the world

2) Multinationals will suffer a drop in earnings in US$ terms. In fact, many companies in the S & P 500 are already facing earnings recession. This will not support the lofty valuations in the S & P and likely we will see a major correction in the coming months

3) EU GDP growth remains weak, and Japan is in a recession. China could face a hard landing. Despite expanding the monetary base, these countries are not registering the expected growth and this is a clear sign that the global economy is facing a deflation risk

4) Commodity prices are falling to multi-year lows. This is a sign that manufacturing is in recession. There is simply not enough demand to boost prices. To gauge, look no further than the Baltic Index which has fallen below 600

5) The global economy is awash with liquidity and high level of debt. The US has been raising the debt ceiling 6 times since 2009. Tax revenues are falling behind expenditure. To raise interest rates further is akin to borrowing at a higher cost to pay for borrowing at a lower cost. No economy can ever do well when the debt level is more than 100% of the GDP.

All the above does not support a strong Dollar Index. I could only term it as pure speculation. The momentum while strong, will not last.

Many economists are predicting in a 25 - 50 basis point increase in December while some said it could be a gradual 25 basis point increase every quarter in 2016.

I think there could be a possible rate hike in December but after that, the Federal Reserve will be done raising interest rate. I don't think there will be any rate increase in 2016.

The global economic indicators and risks do not support further rate increases.

1) EU, Japan and China will continue their easing policies. This will make US goods more expensive and likely widen the trade deficit between US and the rest of the world

2) Multinationals will suffer a drop in earnings in US$ terms. In fact, many companies in the S & P 500 are already facing earnings recession. This will not support the lofty valuations in the S & P and likely we will see a major correction in the coming months

3) EU GDP growth remains weak, and Japan is in a recession. China could face a hard landing. Despite expanding the monetary base, these countries are not registering the expected growth and this is a clear sign that the global economy is facing a deflation risk

4) Commodity prices are falling to multi-year lows. This is a sign that manufacturing is in recession. There is simply not enough demand to boost prices. To gauge, look no further than the Baltic Index which has fallen below 600

5) The global economy is awash with liquidity and high level of debt. The US has been raising the debt ceiling 6 times since 2009. Tax revenues are falling behind expenditure. To raise interest rates further is akin to borrowing at a higher cost to pay for borrowing at a lower cost. No economy can ever do well when the debt level is more than 100% of the GDP.

All the above does not support a strong Dollar Index. I could only term it as pure speculation. The momentum while strong, will not last.

Friday, November 13, 2015

PPHM UPDATE

PPHM achieved full enrollment for its two-arm Phase 1B Trial combining Bavtuximab with Yervoy, an Anti CTLA-4 drug for advanced melanoma in patients.

The trial is expected to take 12 - 14 weeks with data being possibly available in March 2016.

PPHM had done a pre-clinical trial involving mice and the data showed incredible proof of how Bavituximab could work with another immunotherapy drug to combat melanoma tumours.

The chart above exemplifies the efficacy of Bavituximab equivalent Ch1N11 (for mice) when used with Anti CTLA-4 in combating melanoma tumours.

It shows how Ch1N11 (red colour) alone can handily beat Anti CTLA-4 (blue colour) and how the two combination (green colour) could be a potent mixture which surpassed in efficacy vs each stand alone drug on its own.

My disclosure: I own shares of PPHM.

The trial is expected to take 12 - 14 weeks with data being possibly available in March 2016.

PPHM had done a pre-clinical trial involving mice and the data showed incredible proof of how Bavituximab could work with another immunotherapy drug to combat melanoma tumours.

The chart above exemplifies the efficacy of Bavituximab equivalent Ch1N11 (for mice) when used with Anti CTLA-4 in combating melanoma tumours.

It shows how Ch1N11 (red colour) alone can handily beat Anti CTLA-4 (blue colour) and how the two combination (green colour) could be a potent mixture which surpassed in efficacy vs each stand alone drug on its own.

My disclosure: I own shares of PPHM.

EU'S GDP MISSES TARGET

The EU's third quarter GDP growth missed its target of 0.4%. GDP rose 0.3%, which is down 0.1% form the previous quarter.

Netherlands, Italy and Portugal missed their respective targets by a wide margin. Portugal in fact, remained stagnant with zero growth.

This immediately put pressure on the ECB to intensify their QE.

It will be interesting to watch how the Federal Reserve would react to this latest data.

Netherlands, Italy and Portugal missed their respective targets by a wide margin. Portugal in fact, remained stagnant with zero growth.

This immediately put pressure on the ECB to intensify their QE.

It will be interesting to watch how the Federal Reserve would react to this latest data.

IS CHINA HEADING TOWARDS A DEBT CRISIS?

Bloomberg reported that Chinese banks' troubled loans swelled to almost 4T Yuan or US$628B, the equivalent of Sweden's GDP.

Banks' profit growth also fell from 13% to 2% in the first nine months of the year.

Bad debts continued to pile up recently when China Shanshui Cement Group went into default and prompted its lenders to demand immediate payments.

China's corporate debt is a potential disaster, totaling US$16T. Increasing default, especially by state owned companies which had gone on a borrowing binge in the last few years could shake confidence in the Chinese bond market and economy as a whole.

A recent report by the FSB (Financial Stability Board) shows that China's 4 major banks need to raise almost US$400B in additional capital in order to meet new standards set by the board.

That is why the recent rally in the stock market and prior it, the bond market, has unnerved any economists and analysts. China's weakness remains, and thus, any rally could proved to be a flash in the pan and is not sustainable.

With China being mired in a hard landing and the EU in a state of low growth despite the QE, and at the other end of the table, a potential interest rate hike in the US, we could potentially see another recession in the not too soon future.

Banks' profit growth also fell from 13% to 2% in the first nine months of the year.

Bad debts continued to pile up recently when China Shanshui Cement Group went into default and prompted its lenders to demand immediate payments.

China's corporate debt is a potential disaster, totaling US$16T. Increasing default, especially by state owned companies which had gone on a borrowing binge in the last few years could shake confidence in the Chinese bond market and economy as a whole.

A recent report by the FSB (Financial Stability Board) shows that China's 4 major banks need to raise almost US$400B in additional capital in order to meet new standards set by the board.

That is why the recent rally in the stock market and prior it, the bond market, has unnerved any economists and analysts. China's weakness remains, and thus, any rally could proved to be a flash in the pan and is not sustainable.

With China being mired in a hard landing and the EU in a state of low growth despite the QE, and at the other end of the table, a potential interest rate hike in the US, we could potentially see another recession in the not too soon future.

Thursday, November 12, 2015

OCTOBER JOBS BREAKDOWN IN 3 SIMPLE CHARTS

The following charts are sourced from www.zerohedge.com, and submitted by Tyler Durden.

It is interesting to note Construction added 31,000 jobs in October vs approximately 13,000 jobs in September while Retail Trade added 43,800 jobs in October vs approximately 5,000 jobs in September.

Manufacturing? A big zero.

Tyler Durden raised a valid point when he questioned the data on Retail and Construction.

Let's look at Retail first. September Retail Sales rose an insignificant 0.1% vs 0.2% - 0.3% forecast. Despite the poor data Retail jobs surged almost 800% in October.

Then let's look at Construction. Raw materials have been declining. Framing lumber prices have declined 21% y-o-y.

New home sales fell 11.5% in September vs August (468,000 units vs 529,000 units).

Nevertheless Construction jobs surged more than 130% in October.

There seem to be some disconnect here as jobs continue to grow despite the poor new home sales data.

The following 2 charts perhaps will show some uncanny resemblance of what happened in 2006 and onwards.

Will history repeats itself and we could see a crash further down the road? It does seem likely given the slowing global growth. It's best we start preparing ourselves.

It is interesting to note Construction added 31,000 jobs in October vs approximately 13,000 jobs in September while Retail Trade added 43,800 jobs in October vs approximately 5,000 jobs in September.

Manufacturing? A big zero.

Tyler Durden raised a valid point when he questioned the data on Retail and Construction.

Let's look at Retail first. September Retail Sales rose an insignificant 0.1% vs 0.2% - 0.3% forecast. Despite the poor data Retail jobs surged almost 800% in October.

Then let's look at Construction. Raw materials have been declining. Framing lumber prices have declined 21% y-o-y.

New home sales fell 11.5% in September vs August (468,000 units vs 529,000 units).

Nevertheless Construction jobs surged more than 130% in October.

There seem to be some disconnect here as jobs continue to grow despite the poor new home sales data.

The following 2 charts perhaps will show some uncanny resemblance of what happened in 2006 and onwards.

Will history repeats itself and we could see a crash further down the road? It does seem likely given the slowing global growth. It's best we start preparing ourselves.

Wednesday, November 11, 2015

EIA: US SHALE OIL PRODUCERS COULD SEE PRODUCTION DROP BY 118,000 BOPD IN DECEMBER

According to the EIA, US shale oil production could see a drop of 118,000 bopd in December.

Taking into consideration that US shale oil production has dropped approximately 500,000 bopd from April to October (reported by oilprice.com on 25 October), we could potentially see a combined drop of more than 600,000 bopd in shale oil production as we enter into 2016.

This far surpassed Citigroup's estimated drop of 500,000 bopd by the end of the year. The drop could be more pronounced as we enter Q1 2016. This is supported by the fact that US rigs count has dropped for the last 10 weeks, and further capex has been differed or cancelled.

Will continued drop in US production push oil price northwards?

I am inclined to believe so, even with Iran coming into the picture. This is because Iranian oil needs investment from major oil companies to kickstart its oil ambition and right now all oil majors have no intention to commit further capex in either oil exploration or oil field development.

According to Marketwatch (reported on 10 November), more than US$200 billion of energy projects have been cancelled thus far. So I believe it is unlikely that Iran would be able to secure enough investments to develop its oil fields in order for it to meet its targeted production in 2016.

In such a scenario, oil price could finally stabilise. I believe by Q1 2016, we could see oil price above US$50 a barrel.

The above is just my opinion. You are encouraged to do your own research.

Link: http://www.kallanishenergy.com/2015/11/11/shale-oil-production-drop-118000-bpd-eia/

Taking into consideration that US shale oil production has dropped approximately 500,000 bopd from April to October (reported by oilprice.com on 25 October), we could potentially see a combined drop of more than 600,000 bopd in shale oil production as we enter into 2016.

This far surpassed Citigroup's estimated drop of 500,000 bopd by the end of the year. The drop could be more pronounced as we enter Q1 2016. This is supported by the fact that US rigs count has dropped for the last 10 weeks, and further capex has been differed or cancelled.

Will continued drop in US production push oil price northwards?

I am inclined to believe so, even with Iran coming into the picture. This is because Iranian oil needs investment from major oil companies to kickstart its oil ambition and right now all oil majors have no intention to commit further capex in either oil exploration or oil field development.

According to Marketwatch (reported on 10 November), more than US$200 billion of energy projects have been cancelled thus far. So I believe it is unlikely that Iran would be able to secure enough investments to develop its oil fields in order for it to meet its targeted production in 2016.

In such a scenario, oil price could finally stabilise. I believe by Q1 2016, we could see oil price above US$50 a barrel.

The above is just my opinion. You are encouraged to do your own research.

Link: http://www.kallanishenergy.com/2015/11/11/shale-oil-production-drop-118000-bpd-eia/

Monday, November 9, 2015

IS THE RATE HIKE IMMINENT?

Since 2009, the US government has raised the debt limit 6 times, increasing it by US$5,709B to US$18,113 to date.

Taking this into consideration, US tax receipts is not enough to cover the the government expenditure, and thus the need to raise debt to cover the difference. With US$5,709B raised since 2009 at near zero interest rate, any interest rate hike will not only increase the borrowing costs for the government as the US will likely to continue issuing debts to cover its own shortfall.

When the amount runs into trillions of US$, the interest payment will be a nightmare. So will the Federal Reserve take on a hawkish stance knowing that it could cause a ripple effect which will result in heavier borrowing costs for the US and impact upon its trade balances as US made goods become expensive in the global market?

Just today the OECD trimmed the global economy outlook to 2.9% vs 3.3% previously. Therefore a potential interest rate hike could tip the outlook below 2.9%.

China meanwhile released its export and import numbers which were far from impressive. Exports dropped 6.9% while import fell 18.8%. The trade surplus widened US$61.64B. The trade imbalance with US could widen further should the US$ continue to strengthen.

Maersk also reiterated recently that global GDP is worse than forecast based on their knowledge of the amount of goods shipped globally.

Against such a backdrop, I am compelled to opine that a rate hike should not happen. But the Federal Reserve's reputation is at stake. So I think a rate hike, while not imminent, could be possible, just so the proponents of a rate hike stay of f its back. It will be followed by a long pause before any rate hike kicks in again.

The above is just my opinion of course.

Taking this into consideration, US tax receipts is not enough to cover the the government expenditure, and thus the need to raise debt to cover the difference. With US$5,709B raised since 2009 at near zero interest rate, any interest rate hike will not only increase the borrowing costs for the government as the US will likely to continue issuing debts to cover its own shortfall.

When the amount runs into trillions of US$, the interest payment will be a nightmare. So will the Federal Reserve take on a hawkish stance knowing that it could cause a ripple effect which will result in heavier borrowing costs for the US and impact upon its trade balances as US made goods become expensive in the global market?

Just today the OECD trimmed the global economy outlook to 2.9% vs 3.3% previously. Therefore a potential interest rate hike could tip the outlook below 2.9%.

China meanwhile released its export and import numbers which were far from impressive. Exports dropped 6.9% while import fell 18.8%. The trade surplus widened US$61.64B. The trade imbalance with US could widen further should the US$ continue to strengthen.

Maersk also reiterated recently that global GDP is worse than forecast based on their knowledge of the amount of goods shipped globally.

Against such a backdrop, I am compelled to opine that a rate hike should not happen. But the Federal Reserve's reputation is at stake. So I think a rate hike, while not imminent, could be possible, just so the proponents of a rate hike stay of f its back. It will be followed by a long pause before any rate hike kicks in again.

The above is just my opinion of course.

WHAT BANKING GIANTS NEED TO DO TO PREVENT ANOTHER LEHMAN LIKE CRISIS

This article by Bloomberg is an interesting read.

The Financial Stability Board (FSB) created in the aftermath of the Global Financial Crisis announced that the most systematically important lenders must have total loss-absorbing capacity equivalent to at least 16% of risk-weighted assets in 2019, rising to 18% in 2022. A leverage ratio requirement will also be imposed, rising from 6% initially to 6.75%.

Pay attention to the statement that including China's 4 major banks, the banking giants of the world need to raise additional 457B Euros to 1.1T Euros. Excluding the big in China, the amount they need to raise is 107B Euros to 776B Euros. (You can then imagine how much capital the 4 China banks need to raise and appreciate the challenge confronting the Chinese banks).

It is the view of the FSB that 2/3 of the 30 major lenders of the world will need to raise additional capital to meet the new standards.

Link: http://www.bloomberg.com/news/articles/2015-11-09/banking-giants-learn-cost-of-preventing-another-lehman-moment

The Financial Stability Board (FSB) created in the aftermath of the Global Financial Crisis announced that the most systematically important lenders must have total loss-absorbing capacity equivalent to at least 16% of risk-weighted assets in 2019, rising to 18% in 2022. A leverage ratio requirement will also be imposed, rising from 6% initially to 6.75%.

Pay attention to the statement that including China's 4 major banks, the banking giants of the world need to raise additional 457B Euros to 1.1T Euros. Excluding the big in China, the amount they need to raise is 107B Euros to 776B Euros. (You can then imagine how much capital the 4 China banks need to raise and appreciate the challenge confronting the Chinese banks).

It is the view of the FSB that 2/3 of the 30 major lenders of the world will need to raise additional capital to meet the new standards.

Link: http://www.bloomberg.com/news/articles/2015-11-09/banking-giants-learn-cost-of-preventing-another-lehman-moment

Thursday, November 5, 2015

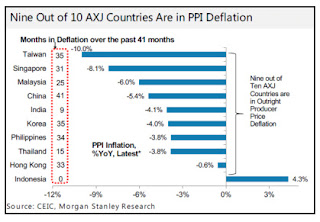

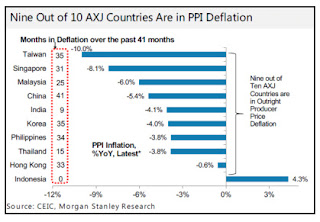

IS ASIA HEADING INTO A DEFLATION?

Is Asia heading into a deflationary economy? This is perhaps the reason why central banks in Asia are on an easing mode to stimulate growth and hence inflation. But the drag seems to continue. Deflation is harder to combat vs inflation. Japan for example has been battling it for 25 years. And now Abenomics, after the initial burst, seems to fall behind the BOJ's targets. Worse still EU countries are displaying similar patterns. Just my opinion of course, but it pays to be mindful about global events taking place.

Chart source: elliotwave.com

Chart source: elliotwave.com

Wednesday, November 4, 2015

LGO UPDATE

LGO reported that the loss of Well 678 could amount to approximately US$4 million. Nevertheless, LGO continues to meet its payment commitments to BNP Paribas as planned.

The company is now looking at several options to bridge the funding gap that the loss has created. This includes the appointment of Wellford Capital Markets LLC and Height Securities to jointly advise on strategic investments int he business. both will be retained for a period of 3 months and will work with the management to define options for longer sustainability, including sourcing strategic investors and the possible refinancing of the existing bank loan.

Operations at Goudron Field will continue with operating costs continuing to be met from production revenue, funds held by LGO and those being released by the bank.

Production in Spain improved to 186 bopd after well cleanout works in the summer. group production currently stands at 896 bopd due to continuing depletion in the field and slowing of work on the Gourdon Sandstone programme.

No doubt the setback had dealt a cruel blow to LGO's ambitions, but with more than 800 million of oil in place, it is just a matter of getting the funding going again to get production moving. I remain cautiously optimistic that LGO will get its act together, and with the eventual increase in oil price int he coming months, this setback will a thing of the past. still investing in UK AIM stocks is a high risk affair and it is important that you do your own due diligence.

My disclosure: I own LGO shares.

A PRECLUDE TO A FINANCIAL STORM TO IN ASIA?

Standard Charted has a strong foothold in Asia, where it has a presence for over a hundred years. Asia has always been a part of Standard Charted's core business.

In Q3, Standard Charted reported a loss of US$139 million due to impairment costs amounting US$1,230 million. The majority of the impairment costs are loan related. That it a hefty write off and perhaps is a signal that all is not well in Asia.

Now, Standard Charted needs to raise additional capital amounting to US$5.1 billion and cut 15,000 jobs globally.

If anything, it goes to show that Asia could register more defaults in coming months, brought on by a strengthening US$, low commodity prices, and asset bubbles.

Read it all here: http://www.bloomberg.com/news/articles/2015-11-04/standard-chartered-s-bad-loans-reveal-cracks-in-asian-economies

In Q3, Standard Charted reported a loss of US$139 million due to impairment costs amounting US$1,230 million. The majority of the impairment costs are loan related. That it a hefty write off and perhaps is a signal that all is not well in Asia.

Now, Standard Charted needs to raise additional capital amounting to US$5.1 billion and cut 15,000 jobs globally.

If anything, it goes to show that Asia could register more defaults in coming months, brought on by a strengthening US$, low commodity prices, and asset bubbles.

Read it all here: http://www.bloomberg.com/news/articles/2015-11-04/standard-chartered-s-bad-loans-reveal-cracks-in-asian-economies

Saturday, October 31, 2015

PPHM SHARES PURCHASE BY EASTERN CAPITAL

PPHM announced that Eastern Capital has purchased 18.5 million shares of PPHM valued at US$1.08 per share. This makes Eastern Capital one of the largest institution investors on board.

This is an important development as it allows PPHM to continue to pursue its many trials involving their lead drug Bavituximab with various collaborators' drugs, especially with AstraZeneca's durvalumab which has now been expanded into a global Phase II study, capitalising on Astrazeneca's global network.

Still, the main driver of PPHM's growth will be the eventual approval of Bavituximab by the FDA.

This is an important development as it allows PPHM to continue to pursue its many trials involving their lead drug Bavituximab with various collaborators' drugs, especially with AstraZeneca's durvalumab which has now been expanded into a global Phase II study, capitalising on Astrazeneca's global network.

Still, the main driver of PPHM's growth will be the eventual approval of Bavituximab by the FDA.

US OIL RIGS COUNT

US oil rigs count dropped further on the week ending 30 October as drillers removed 16 wells from the field, bringing the total of rigs count still in service to 578. This is the ninth consecutive week that the rigs count has dropped.

This provided additional support for oil price which closed higher at US$46.59 per barrel.

US refineries will be coming back on line soon after a period of maintenance and thus would continue their draw down from the stockpiles, which are already at high levels. This could provide additional support to the price of oil in the coming weeks.

Previously, I have mentioned that October could be a day of reckoning for many oil producers as financial institutions review the credit lines offered to the many stricken oil producers. Looks like they have a second lease of life as many had their credit lines maintained and only a small handful had theirs lowered.

This will put some financial institutions at risk further as many of the oil producers are at risk of default. By extending a temporary lifeline until the next review in spring next year is akin to kicking the can down the road.

Perhaps in part, the financial institutions' decision had been driven by the news that US oil production is finally showing signs of slowing down. In part it has dropped by 500,000 bopd since April.

Continuous drop in production could help oil price to stabilise and the much needed impetus to move northwards one again.

This provided additional support for oil price which closed higher at US$46.59 per barrel.

US refineries will be coming back on line soon after a period of maintenance and thus would continue their draw down from the stockpiles, which are already at high levels. This could provide additional support to the price of oil in the coming weeks.

Previously, I have mentioned that October could be a day of reckoning for many oil producers as financial institutions review the credit lines offered to the many stricken oil producers. Looks like they have a second lease of life as many had their credit lines maintained and only a small handful had theirs lowered.

This will put some financial institutions at risk further as many of the oil producers are at risk of default. By extending a temporary lifeline until the next review in spring next year is akin to kicking the can down the road.

Perhaps in part, the financial institutions' decision had been driven by the news that US oil production is finally showing signs of slowing down. In part it has dropped by 500,000 bopd since April.

Continuous drop in production could help oil price to stabilise and the much needed impetus to move northwards one again.

Thursday, October 29, 2015

US GDP TAKEAWAYS

US' Q3 GDP grew 1.5% vs a forecast of 1.6%. This is a sharp contrast from the 3.9% achieved in Q2.

Consumer spending again is the prime driver, delivering 3.2% in growth. Inventories contracted, shaving 1.44% off the GDP.

The robust consumer spending of curse led many to believe that the Federal Reserve will likely raise the interest rates in December.

Herein lies the question: If consumer spending is going to be robust, why the need to cut inventories? Of course, on the other side of the coin, the cut in inventories was viewed as cyclical and should correct itself in the ensuing months.

The anticipation of a rate hike immediately push majority of commodity prices down, due to the strengthening of the US$.

At this juncture, the GDP remains preliminary as there will be revisions later on. My bet is that it will be revised down from 1.5%.

This is because of a string of data released showed some disturbing trends in September:

1) New home sales is down

2) Pending home sales is down

3) US business spending gauge fell

Still the November 6 Jobs Report will give a better indication in the direction of the Federal Reserve.

Should there be an interest rate hike, we could see general weakness and potential recession in emerging markets.

The above is just my opinion. You are encouraged to do your own research.

Consumer spending again is the prime driver, delivering 3.2% in growth. Inventories contracted, shaving 1.44% off the GDP.

The robust consumer spending of curse led many to believe that the Federal Reserve will likely raise the interest rates in December.

Herein lies the question: If consumer spending is going to be robust, why the need to cut inventories? Of course, on the other side of the coin, the cut in inventories was viewed as cyclical and should correct itself in the ensuing months.

The anticipation of a rate hike immediately push majority of commodity prices down, due to the strengthening of the US$.

At this juncture, the GDP remains preliminary as there will be revisions later on. My bet is that it will be revised down from 1.5%.

This is because of a string of data released showed some disturbing trends in September:

1) New home sales is down

2) Pending home sales is down

3) US business spending gauge fell

Still the November 6 Jobs Report will give a better indication in the direction of the Federal Reserve.

Should there be an interest rate hike, we could see general weakness and potential recession in emerging markets.

The above is just my opinion. You are encouraged to do your own research.

Wednesday, October 28, 2015

FOMC: KEY FACTORS WHICH ARE ABOUT TO DO A U-TURN

In the minutes, the FOMC quoted:

"September suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates and housing sector has improved further, however, net exports have been soft "

Household Spending

September Consumer Confidence Index 102.6

October Consumer Confidence Index 97.6 (drop of 5.0 month on month)

September US Retail Sales rose by a mere 0.1% with August revised down as being unchanged instead of a rise of 0.2%.

Business Fixed Investment

On the day of the FOMC meets, Durable Goods contracted 1.2% in September, with August's contraction revised lower to minus 3.0%.

Housing Sector

A day before the FOMC meets, new home sales fell to an annual rate of 468,000 in September, 67,000 below the low-end of estimate and lowest rate since November 2014.

August new home sales was revised down by 33,000.

MBA Mortgage Applications

On the day of the release of the minutes, October purchase applications (for the week ending October 23), slipped 3.0%. while refinancing applications were down 4.0%.

So in a nutshell, based on recent data things are indeed much worse than what the FOMC stated.

How could Household Spending be solid when Retail Sales rose 0.1%? Or when Consumer Confidence declined to 97.6 from 102.6 a month earlier.

How could Business Fixed Investment be solid when Durable Goods fell 1.2% in September?

How could Housing Sector improved further when New Home Sales fell to the lowest in almost a year? How could it when Mortgage applications had also shown declines lately?

These are the same questions that will hound the Federal Reserve. Today's GDP data will give a better indication. Consensus estimate is 1.7% growth, but the widely followed and accurate data at the Atlanta Federal Reserve, shows 0.9%.

One thing for sure, it's going to be a bumpy ride all the way to December. Will the Federal Reserve act to salvage its reputation despite the negative data, or will they admit that the state of the economy does not warrant an interest rate hike as yet.

The above are just my opinion, of course.

"September suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates and housing sector has improved further, however, net exports have been soft "

Household Spending

September Consumer Confidence Index 102.6

October Consumer Confidence Index 97.6 (drop of 5.0 month on month)

September US Retail Sales rose by a mere 0.1% with August revised down as being unchanged instead of a rise of 0.2%.

Business Fixed Investment

On the day of the FOMC meets, Durable Goods contracted 1.2% in September, with August's contraction revised lower to minus 3.0%.

Housing Sector

A day before the FOMC meets, new home sales fell to an annual rate of 468,000 in September, 67,000 below the low-end of estimate and lowest rate since November 2014.

August new home sales was revised down by 33,000.

MBA Mortgage Applications

On the day of the release of the minutes, October purchase applications (for the week ending October 23), slipped 3.0%. while refinancing applications were down 4.0%.

So in a nutshell, based on recent data things are indeed much worse than what the FOMC stated.

How could Household Spending be solid when Retail Sales rose 0.1%? Or when Consumer Confidence declined to 97.6 from 102.6 a month earlier.

How could Business Fixed Investment be solid when Durable Goods fell 1.2% in September?

How could Housing Sector improved further when New Home Sales fell to the lowest in almost a year? How could it when Mortgage applications had also shown declines lately?

These are the same questions that will hound the Federal Reserve. Today's GDP data will give a better indication. Consensus estimate is 1.7% growth, but the widely followed and accurate data at the Atlanta Federal Reserve, shows 0.9%.

One thing for sure, it's going to be a bumpy ride all the way to December. Will the Federal Reserve act to salvage its reputation despite the negative data, or will they admit that the state of the economy does not warrant an interest rate hike as yet.

The above are just my opinion, of course.

NO INTEREST RATE HIKE IN OCTOBER

Well the Federal Reserve had put interest rate on hold, but wording quite strongly that there could be a hike a hike further down the road.

The Federal Reserve has unwittingly painted themselves into a corner. By announcing that there will be a rate hike this year, to not do so, would put the credibility of the Federal Reserve at risk. But global economy indicators are really weak right now, any interest rake hike will push the world into recession.

We have to consider the implications of a rate hike against a backdrop of interest rates and reserve ratios cut by China, and QE in EU and Japan, which have fallen short of expectations. Against a backdrop of falling commodity prices and emerging economies currencies, and falling global trade (with reference to the Baltic Index which have fallen drastically from recent highs) and IMF's forecast of global growth to 3.1% from 3.3%.

Indeed the Federal Reserve is in a tight spot. Likelihood, to salvage whatever reputation they had left, the Federal Reserve will raise interest rate but it will be below market expectations, perhaps? This will be accompanied by a dovish outlook and suggestions that interest rates hike will pause for now.

To do otherwise, the Federal Reserve would push the world into a recession.

I would still prefer gold mining companies as a long term investment, because we could be in a period of having too much liquidity in the market but with limited growth, and of course a potential asset bubble burst in Asia, spiraling into a debt crisis.

For short term trades, I would choose gold, looking for opportunities to short as well as long.

The above is just my opinion. You are encouraged to do your own research.

The Federal Reserve has unwittingly painted themselves into a corner. By announcing that there will be a rate hike this year, to not do so, would put the credibility of the Federal Reserve at risk. But global economy indicators are really weak right now, any interest rake hike will push the world into recession.