According to the media, the expectations that the Federal Reserve would raise interest rate is pushing commodities down due to the rising value of the US$.

We have economists and analysts saying that this is the beginning of a tightening cycle. Gold has lost its shine as it does not earn its investors any dividends or interest.

We have Goldman Sachs predicting that the Federal Reserve will raise its rate in December followed by a 100 basis point increase in 2016 and gold will fall to US$1,000 per oz.

Some even predicted that gold will fall below $1,000 per oz in 2016. The bearish signals are rather overwhelming.

Then incredibly, on 10 August, Speaking Alpha reported that on 6 August, Goldman Sachs bought 3.2 tons of gold while HSBC bought 3.9 tons. Both purchases were recorded as being for the benefit of the banks' own house account.

It leads one to wonder why the bearish call from Goldman Sachs when they are urging traders to sell gold. Reminds me of the CDOs fiasco back in the 2007-2008 period.

Incidentally, while traders have been most bearish on gold, Russia and China have been steadily accumulating as well. Now if gold is going to be worthless, one also wonders why the central bank of both countries are buying gold.

Link http://www.bloomberg.com/news/articles/2015-10-22/fed-getting-started-on-rates-will-hurt-bullion-goldman-predicts

Link: http://seekingalpha.com/article/3421396-the-big-long-goldman-sachs-and-hsbc-buy-7_1-tons-of-physical-gold

Use of information contained in this blog does not constitute any contractual relationship between the reader and the author. The author hereby disclaims all responsibilities and liabilities for any use of information contained in this blog. Readers are advised to exercise due diligence and do their own assessment of the risks involved when investing in any company. Readers shall not hold the author liable for investments which have gone sour.

Sunday, November 29, 2015

Friday, November 27, 2015

LGO UPDATE

LGO announced that it has reached an agreement with BNP Paribas to terminate the prepaid swap at its current value of US10.8M including all future interests and fees.

LGo will have a schedule of repayments, starting with the next three months (December 2015 - February 2016) at a reduced rate of US$75,000 per month, after which the remaining outstanding balance will be recovered over the following 19 months at at rate of approximately 5% per month.

LGO and BNP will continue to have regular constructive discussions aime d at assisting LG to establish a secure and sustainable platform for future investment.

Meanwhile, LGO is working closely with its US advisors, Wellford capital markets and height Securities ons trategic investments in the business. LGO expects to be actively discussing with potential investments with clients of Wellford and Height in the next two months.

The agreement reached with BNP is pivotal to LGo to maintain the momentum in their oil production operations in Trinidad.

My disclosure: I own shares of LGO

LGo will have a schedule of repayments, starting with the next three months (December 2015 - February 2016) at a reduced rate of US$75,000 per month, after which the remaining outstanding balance will be recovered over the following 19 months at at rate of approximately 5% per month.

LGO and BNP will continue to have regular constructive discussions aime d at assisting LG to establish a secure and sustainable platform for future investment.

Meanwhile, LGO is working closely with its US advisors, Wellford capital markets and height Securities ons trategic investments in the business. LGO expects to be actively discussing with potential investments with clients of Wellford and Height in the next two months.

The agreement reached with BNP is pivotal to LGo to maintain the momentum in their oil production operations in Trinidad.

My disclosure: I own shares of LGO

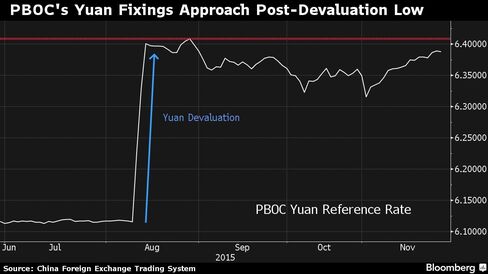

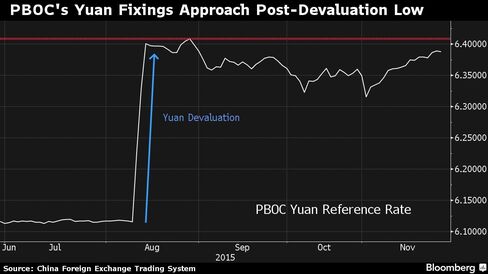

CHINA'S YUAN IS DEPRECIATING AGAIN

China's Yuan is almost back to its devaluation level in August. And I think China's troubles are just beginning.

From Bloomberg website

China has a huge debt problem, almost 300% of its GDP, over capacity in state owned heavy industries such as copper, aluminium and steel. Only as recently, it was reported in the news that many are asking the government to absorb their excess capacity. Several are in default of their debt obligations. Here are some examples in 2015:

1) Kaisa Group interest default (US$52M)

2) Baoding Tianwei Group Co interest default (85.8M Yuan)

3) Sinosteel default on 5.3% interest on 2B Yuan notes

4) Winsay Enterprises Holdings failed to meet interest payment on US$ notes for a second time this year

5) Yunan Coal Chemical Industry Group has 1.31B Yuan of overdue loans

6) Shanshui Cement announced on November 5 that it could default on its interest payment

I am expecting more defaults to come by early next year as manufacturing continues to contract. China's PMI has fallen below 50 for the past few months. 50 signals expansion while below 50 signals contraction. This is amidst a wave falling exports which crimped revenue in the manufacturing sector.

It is best to stay off any investment in China, and that include mainland Chinese stocks, bonds and currency. The worst is yet to come. If you should invest in China, go for companies listed in the US or HK instead, but only companies with very strong balance sheets.

From Bloomberg website

China has a huge debt problem, almost 300% of its GDP, over capacity in state owned heavy industries such as copper, aluminium and steel. Only as recently, it was reported in the news that many are asking the government to absorb their excess capacity. Several are in default of their debt obligations. Here are some examples in 2015:

1) Kaisa Group interest default (US$52M)

2) Baoding Tianwei Group Co interest default (85.8M Yuan)

3) Sinosteel default on 5.3% interest on 2B Yuan notes

4) Winsay Enterprises Holdings failed to meet interest payment on US$ notes for a second time this year

5) Yunan Coal Chemical Industry Group has 1.31B Yuan of overdue loans

6) Shanshui Cement announced on November 5 that it could default on its interest payment

I am expecting more defaults to come by early next year as manufacturing continues to contract. China's PMI has fallen below 50 for the past few months. 50 signals expansion while below 50 signals contraction. This is amidst a wave falling exports which crimped revenue in the manufacturing sector.

It is best to stay off any investment in China, and that include mainland Chinese stocks, bonds and currency. The worst is yet to come. If you should invest in China, go for companies listed in the US or HK instead, but only companies with very strong balance sheets.

Tuesday, November 24, 2015

GLOBAL DEBT HAS REACHED US$230T.

Global debt has reached US$230T whcih is 313% of the gloabl annual GDP. Financial derivatives market itself is worth some US$700T!

So who thinks the federal reserve will continue to raise rates?

There could be a Q4 sooner than we think.

Link: http://www.mybudget360.com/global-debt-total-amount-of-debt-world-gdp-to-debt-ratios/

So who thinks the federal reserve will continue to raise rates?

There could be a Q4 sooner than we think.

Link: http://www.mybudget360.com/global-debt-total-amount-of-debt-world-gdp-to-debt-ratios/

Monday, November 23, 2015

US OIL RIGS COUNT FELL 10 FOR WEEK ENDING 20 NOVEMBER, 2015

US oil rigs count fell by 10 for the week ending 20 November, 2015. Despite the drop in oil rigs count, oil price remained in the US$40 - US$42 range.

Oil price could potentially fall below US$40 in the near term as the glut in supply refuses to give way. This could put many US shale oil companies in jeopardy of defaulting on their heavy debt loads. Re-financing options are thin as many investors and private equity funds got burned, investing billions of dollars in US shale oil companies in spring, believing that oil price would recover towards the end of the year.

As early as Q1 2016 we could witness another round of bankruptcies.

The ball is very much in OPEC's court as many members are facing a squeeze on budget and many more could see their sovereign wealth funds deplete to troublesome levels should oil price fall into the US$30s range.

A proclamation of war on US shale oil has reached a level where there will be no winners but all could wind up as losers.

Oil price could potentially fall below US$40 in the near term as the glut in supply refuses to give way. This could put many US shale oil companies in jeopardy of defaulting on their heavy debt loads. Re-financing options are thin as many investors and private equity funds got burned, investing billions of dollars in US shale oil companies in spring, believing that oil price would recover towards the end of the year.

As early as Q1 2016 we could witness another round of bankruptcies.

The ball is very much in OPEC's court as many members are facing a squeeze on budget and many more could see their sovereign wealth funds deplete to troublesome levels should oil price fall into the US$30s range.

A proclamation of war on US shale oil has reached a level where there will be no winners but all could wind up as losers.

Sunday, November 22, 2015

DOLLAR INDEX BRIEFLY TOUCHED 100

The Dollar Index briefly touched 100 this morning. In view of its momentum, it could well go above that mark in expectation of the Federal Reserve hiking the US interest rate for the first time in almost a decade.

Many economists are predicting in a 25 - 50 basis point increase in December while some said it could be a gradual 25 basis point increase every quarter in 2016.

I think there could be a possible rate hike in December but after that, the Federal Reserve will be done raising interest rate. I don't think there will be any rate increase in 2016.

The global economic indicators and risks do not support further rate increases.

1) EU, Japan and China will continue their easing policies. This will make US goods more expensive and likely widen the trade deficit between US and the rest of the world

2) Multinationals will suffer a drop in earnings in US$ terms. In fact, many companies in the S & P 500 are already facing earnings recession. This will not support the lofty valuations in the S & P and likely we will see a major correction in the coming months

3) EU GDP growth remains weak, and Japan is in a recession. China could face a hard landing. Despite expanding the monetary base, these countries are not registering the expected growth and this is a clear sign that the global economy is facing a deflation risk

4) Commodity prices are falling to multi-year lows. This is a sign that manufacturing is in recession. There is simply not enough demand to boost prices. To gauge, look no further than the Baltic Index which has fallen below 600

5) The global economy is awash with liquidity and high level of debt. The US has been raising the debt ceiling 6 times since 2009. Tax revenues are falling behind expenditure. To raise interest rates further is akin to borrowing at a higher cost to pay for borrowing at a lower cost. No economy can ever do well when the debt level is more than 100% of the GDP.

All the above does not support a strong Dollar Index. I could only term it as pure speculation. The momentum while strong, will not last.

Many economists are predicting in a 25 - 50 basis point increase in December while some said it could be a gradual 25 basis point increase every quarter in 2016.

I think there could be a possible rate hike in December but after that, the Federal Reserve will be done raising interest rate. I don't think there will be any rate increase in 2016.

The global economic indicators and risks do not support further rate increases.

1) EU, Japan and China will continue their easing policies. This will make US goods more expensive and likely widen the trade deficit between US and the rest of the world

2) Multinationals will suffer a drop in earnings in US$ terms. In fact, many companies in the S & P 500 are already facing earnings recession. This will not support the lofty valuations in the S & P and likely we will see a major correction in the coming months

3) EU GDP growth remains weak, and Japan is in a recession. China could face a hard landing. Despite expanding the monetary base, these countries are not registering the expected growth and this is a clear sign that the global economy is facing a deflation risk

4) Commodity prices are falling to multi-year lows. This is a sign that manufacturing is in recession. There is simply not enough demand to boost prices. To gauge, look no further than the Baltic Index which has fallen below 600

5) The global economy is awash with liquidity and high level of debt. The US has been raising the debt ceiling 6 times since 2009. Tax revenues are falling behind expenditure. To raise interest rates further is akin to borrowing at a higher cost to pay for borrowing at a lower cost. No economy can ever do well when the debt level is more than 100% of the GDP.

All the above does not support a strong Dollar Index. I could only term it as pure speculation. The momentum while strong, will not last.

Friday, November 13, 2015

PPHM UPDATE

PPHM achieved full enrollment for its two-arm Phase 1B Trial combining Bavtuximab with Yervoy, an Anti CTLA-4 drug for advanced melanoma in patients.

The trial is expected to take 12 - 14 weeks with data being possibly available in March 2016.

PPHM had done a pre-clinical trial involving mice and the data showed incredible proof of how Bavituximab could work with another immunotherapy drug to combat melanoma tumours.

The chart above exemplifies the efficacy of Bavituximab equivalent Ch1N11 (for mice) when used with Anti CTLA-4 in combating melanoma tumours.

It shows how Ch1N11 (red colour) alone can handily beat Anti CTLA-4 (blue colour) and how the two combination (green colour) could be a potent mixture which surpassed in efficacy vs each stand alone drug on its own.

My disclosure: I own shares of PPHM.

The trial is expected to take 12 - 14 weeks with data being possibly available in March 2016.

PPHM had done a pre-clinical trial involving mice and the data showed incredible proof of how Bavituximab could work with another immunotherapy drug to combat melanoma tumours.

The chart above exemplifies the efficacy of Bavituximab equivalent Ch1N11 (for mice) when used with Anti CTLA-4 in combating melanoma tumours.

It shows how Ch1N11 (red colour) alone can handily beat Anti CTLA-4 (blue colour) and how the two combination (green colour) could be a potent mixture which surpassed in efficacy vs each stand alone drug on its own.

My disclosure: I own shares of PPHM.

EU'S GDP MISSES TARGET

The EU's third quarter GDP growth missed its target of 0.4%. GDP rose 0.3%, which is down 0.1% form the previous quarter.

Netherlands, Italy and Portugal missed their respective targets by a wide margin. Portugal in fact, remained stagnant with zero growth.

This immediately put pressure on the ECB to intensify their QE.

It will be interesting to watch how the Federal Reserve would react to this latest data.

Netherlands, Italy and Portugal missed their respective targets by a wide margin. Portugal in fact, remained stagnant with zero growth.

This immediately put pressure on the ECB to intensify their QE.

It will be interesting to watch how the Federal Reserve would react to this latest data.

IS CHINA HEADING TOWARDS A DEBT CRISIS?

Bloomberg reported that Chinese banks' troubled loans swelled to almost 4T Yuan or US$628B, the equivalent of Sweden's GDP.

Banks' profit growth also fell from 13% to 2% in the first nine months of the year.

Bad debts continued to pile up recently when China Shanshui Cement Group went into default and prompted its lenders to demand immediate payments.

China's corporate debt is a potential disaster, totaling US$16T. Increasing default, especially by state owned companies which had gone on a borrowing binge in the last few years could shake confidence in the Chinese bond market and economy as a whole.

A recent report by the FSB (Financial Stability Board) shows that China's 4 major banks need to raise almost US$400B in additional capital in order to meet new standards set by the board.

That is why the recent rally in the stock market and prior it, the bond market, has unnerved any economists and analysts. China's weakness remains, and thus, any rally could proved to be a flash in the pan and is not sustainable.

With China being mired in a hard landing and the EU in a state of low growth despite the QE, and at the other end of the table, a potential interest rate hike in the US, we could potentially see another recession in the not too soon future.

Banks' profit growth also fell from 13% to 2% in the first nine months of the year.

Bad debts continued to pile up recently when China Shanshui Cement Group went into default and prompted its lenders to demand immediate payments.

China's corporate debt is a potential disaster, totaling US$16T. Increasing default, especially by state owned companies which had gone on a borrowing binge in the last few years could shake confidence in the Chinese bond market and economy as a whole.

A recent report by the FSB (Financial Stability Board) shows that China's 4 major banks need to raise almost US$400B in additional capital in order to meet new standards set by the board.

That is why the recent rally in the stock market and prior it, the bond market, has unnerved any economists and analysts. China's weakness remains, and thus, any rally could proved to be a flash in the pan and is not sustainable.

With China being mired in a hard landing and the EU in a state of low growth despite the QE, and at the other end of the table, a potential interest rate hike in the US, we could potentially see another recession in the not too soon future.

Thursday, November 12, 2015

OCTOBER JOBS BREAKDOWN IN 3 SIMPLE CHARTS

The following charts are sourced from www.zerohedge.com, and submitted by Tyler Durden.

It is interesting to note Construction added 31,000 jobs in October vs approximately 13,000 jobs in September while Retail Trade added 43,800 jobs in October vs approximately 5,000 jobs in September.

Manufacturing? A big zero.

Tyler Durden raised a valid point when he questioned the data on Retail and Construction.

Let's look at Retail first. September Retail Sales rose an insignificant 0.1% vs 0.2% - 0.3% forecast. Despite the poor data Retail jobs surged almost 800% in October.

Then let's look at Construction. Raw materials have been declining. Framing lumber prices have declined 21% y-o-y.

New home sales fell 11.5% in September vs August (468,000 units vs 529,000 units).

Nevertheless Construction jobs surged more than 130% in October.

There seem to be some disconnect here as jobs continue to grow despite the poor new home sales data.

The following 2 charts perhaps will show some uncanny resemblance of what happened in 2006 and onwards.

Will history repeats itself and we could see a crash further down the road? It does seem likely given the slowing global growth. It's best we start preparing ourselves.

It is interesting to note Construction added 31,000 jobs in October vs approximately 13,000 jobs in September while Retail Trade added 43,800 jobs in October vs approximately 5,000 jobs in September.

Manufacturing? A big zero.

Tyler Durden raised a valid point when he questioned the data on Retail and Construction.

Let's look at Retail first. September Retail Sales rose an insignificant 0.1% vs 0.2% - 0.3% forecast. Despite the poor data Retail jobs surged almost 800% in October.

Then let's look at Construction. Raw materials have been declining. Framing lumber prices have declined 21% y-o-y.

New home sales fell 11.5% in September vs August (468,000 units vs 529,000 units).

Nevertheless Construction jobs surged more than 130% in October.

There seem to be some disconnect here as jobs continue to grow despite the poor new home sales data.

The following 2 charts perhaps will show some uncanny resemblance of what happened in 2006 and onwards.

Will history repeats itself and we could see a crash further down the road? It does seem likely given the slowing global growth. It's best we start preparing ourselves.

Wednesday, November 11, 2015

EIA: US SHALE OIL PRODUCERS COULD SEE PRODUCTION DROP BY 118,000 BOPD IN DECEMBER

According to the EIA, US shale oil production could see a drop of 118,000 bopd in December.

Taking into consideration that US shale oil production has dropped approximately 500,000 bopd from April to October (reported by oilprice.com on 25 October), we could potentially see a combined drop of more than 600,000 bopd in shale oil production as we enter into 2016.

This far surpassed Citigroup's estimated drop of 500,000 bopd by the end of the year. The drop could be more pronounced as we enter Q1 2016. This is supported by the fact that US rigs count has dropped for the last 10 weeks, and further capex has been differed or cancelled.

Will continued drop in US production push oil price northwards?

I am inclined to believe so, even with Iran coming into the picture. This is because Iranian oil needs investment from major oil companies to kickstart its oil ambition and right now all oil majors have no intention to commit further capex in either oil exploration or oil field development.

According to Marketwatch (reported on 10 November), more than US$200 billion of energy projects have been cancelled thus far. So I believe it is unlikely that Iran would be able to secure enough investments to develop its oil fields in order for it to meet its targeted production in 2016.

In such a scenario, oil price could finally stabilise. I believe by Q1 2016, we could see oil price above US$50 a barrel.

The above is just my opinion. You are encouraged to do your own research.

Link: http://www.kallanishenergy.com/2015/11/11/shale-oil-production-drop-118000-bpd-eia/

Taking into consideration that US shale oil production has dropped approximately 500,000 bopd from April to October (reported by oilprice.com on 25 October), we could potentially see a combined drop of more than 600,000 bopd in shale oil production as we enter into 2016.

This far surpassed Citigroup's estimated drop of 500,000 bopd by the end of the year. The drop could be more pronounced as we enter Q1 2016. This is supported by the fact that US rigs count has dropped for the last 10 weeks, and further capex has been differed or cancelled.

Will continued drop in US production push oil price northwards?

I am inclined to believe so, even with Iran coming into the picture. This is because Iranian oil needs investment from major oil companies to kickstart its oil ambition and right now all oil majors have no intention to commit further capex in either oil exploration or oil field development.

According to Marketwatch (reported on 10 November), more than US$200 billion of energy projects have been cancelled thus far. So I believe it is unlikely that Iran would be able to secure enough investments to develop its oil fields in order for it to meet its targeted production in 2016.

In such a scenario, oil price could finally stabilise. I believe by Q1 2016, we could see oil price above US$50 a barrel.

The above is just my opinion. You are encouraged to do your own research.

Link: http://www.kallanishenergy.com/2015/11/11/shale-oil-production-drop-118000-bpd-eia/

Monday, November 9, 2015

IS THE RATE HIKE IMMINENT?

Since 2009, the US government has raised the debt limit 6 times, increasing it by US$5,709B to US$18,113 to date.

Taking this into consideration, US tax receipts is not enough to cover the the government expenditure, and thus the need to raise debt to cover the difference. With US$5,709B raised since 2009 at near zero interest rate, any interest rate hike will not only increase the borrowing costs for the government as the US will likely to continue issuing debts to cover its own shortfall.

When the amount runs into trillions of US$, the interest payment will be a nightmare. So will the Federal Reserve take on a hawkish stance knowing that it could cause a ripple effect which will result in heavier borrowing costs for the US and impact upon its trade balances as US made goods become expensive in the global market?

Just today the OECD trimmed the global economy outlook to 2.9% vs 3.3% previously. Therefore a potential interest rate hike could tip the outlook below 2.9%.

China meanwhile released its export and import numbers which were far from impressive. Exports dropped 6.9% while import fell 18.8%. The trade surplus widened US$61.64B. The trade imbalance with US could widen further should the US$ continue to strengthen.

Maersk also reiterated recently that global GDP is worse than forecast based on their knowledge of the amount of goods shipped globally.

Against such a backdrop, I am compelled to opine that a rate hike should not happen. But the Federal Reserve's reputation is at stake. So I think a rate hike, while not imminent, could be possible, just so the proponents of a rate hike stay of f its back. It will be followed by a long pause before any rate hike kicks in again.

The above is just my opinion of course.

Taking this into consideration, US tax receipts is not enough to cover the the government expenditure, and thus the need to raise debt to cover the difference. With US$5,709B raised since 2009 at near zero interest rate, any interest rate hike will not only increase the borrowing costs for the government as the US will likely to continue issuing debts to cover its own shortfall.

When the amount runs into trillions of US$, the interest payment will be a nightmare. So will the Federal Reserve take on a hawkish stance knowing that it could cause a ripple effect which will result in heavier borrowing costs for the US and impact upon its trade balances as US made goods become expensive in the global market?

Just today the OECD trimmed the global economy outlook to 2.9% vs 3.3% previously. Therefore a potential interest rate hike could tip the outlook below 2.9%.

China meanwhile released its export and import numbers which were far from impressive. Exports dropped 6.9% while import fell 18.8%. The trade surplus widened US$61.64B. The trade imbalance with US could widen further should the US$ continue to strengthen.

Maersk also reiterated recently that global GDP is worse than forecast based on their knowledge of the amount of goods shipped globally.

Against such a backdrop, I am compelled to opine that a rate hike should not happen. But the Federal Reserve's reputation is at stake. So I think a rate hike, while not imminent, could be possible, just so the proponents of a rate hike stay of f its back. It will be followed by a long pause before any rate hike kicks in again.

The above is just my opinion of course.

WHAT BANKING GIANTS NEED TO DO TO PREVENT ANOTHER LEHMAN LIKE CRISIS

This article by Bloomberg is an interesting read.

The Financial Stability Board (FSB) created in the aftermath of the Global Financial Crisis announced that the most systematically important lenders must have total loss-absorbing capacity equivalent to at least 16% of risk-weighted assets in 2019, rising to 18% in 2022. A leverage ratio requirement will also be imposed, rising from 6% initially to 6.75%.

Pay attention to the statement that including China's 4 major banks, the banking giants of the world need to raise additional 457B Euros to 1.1T Euros. Excluding the big in China, the amount they need to raise is 107B Euros to 776B Euros. (You can then imagine how much capital the 4 China banks need to raise and appreciate the challenge confronting the Chinese banks).

It is the view of the FSB that 2/3 of the 30 major lenders of the world will need to raise additional capital to meet the new standards.

Link: http://www.bloomberg.com/news/articles/2015-11-09/banking-giants-learn-cost-of-preventing-another-lehman-moment

The Financial Stability Board (FSB) created in the aftermath of the Global Financial Crisis announced that the most systematically important lenders must have total loss-absorbing capacity equivalent to at least 16% of risk-weighted assets in 2019, rising to 18% in 2022. A leverage ratio requirement will also be imposed, rising from 6% initially to 6.75%.

Pay attention to the statement that including China's 4 major banks, the banking giants of the world need to raise additional 457B Euros to 1.1T Euros. Excluding the big in China, the amount they need to raise is 107B Euros to 776B Euros. (You can then imagine how much capital the 4 China banks need to raise and appreciate the challenge confronting the Chinese banks).

It is the view of the FSB that 2/3 of the 30 major lenders of the world will need to raise additional capital to meet the new standards.

Link: http://www.bloomberg.com/news/articles/2015-11-09/banking-giants-learn-cost-of-preventing-another-lehman-moment

Thursday, November 5, 2015

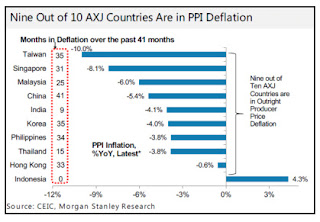

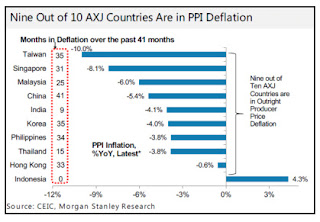

IS ASIA HEADING INTO A DEFLATION?

Is Asia heading into a deflationary economy? This is perhaps the reason why central banks in Asia are on an easing mode to stimulate growth and hence inflation. But the drag seems to continue. Deflation is harder to combat vs inflation. Japan for example has been battling it for 25 years. And now Abenomics, after the initial burst, seems to fall behind the BOJ's targets. Worse still EU countries are displaying similar patterns. Just my opinion of course, but it pays to be mindful about global events taking place.

Chart source: elliotwave.com

Chart source: elliotwave.com

Wednesday, November 4, 2015

LGO UPDATE

LGO reported that the loss of Well 678 could amount to approximately US$4 million. Nevertheless, LGO continues to meet its payment commitments to BNP Paribas as planned.

The company is now looking at several options to bridge the funding gap that the loss has created. This includes the appointment of Wellford Capital Markets LLC and Height Securities to jointly advise on strategic investments int he business. both will be retained for a period of 3 months and will work with the management to define options for longer sustainability, including sourcing strategic investors and the possible refinancing of the existing bank loan.

Operations at Goudron Field will continue with operating costs continuing to be met from production revenue, funds held by LGO and those being released by the bank.

Production in Spain improved to 186 bopd after well cleanout works in the summer. group production currently stands at 896 bopd due to continuing depletion in the field and slowing of work on the Gourdon Sandstone programme.

No doubt the setback had dealt a cruel blow to LGO's ambitions, but with more than 800 million of oil in place, it is just a matter of getting the funding going again to get production moving. I remain cautiously optimistic that LGO will get its act together, and with the eventual increase in oil price int he coming months, this setback will a thing of the past. still investing in UK AIM stocks is a high risk affair and it is important that you do your own due diligence.

My disclosure: I own LGO shares.

A PRECLUDE TO A FINANCIAL STORM TO IN ASIA?

Standard Charted has a strong foothold in Asia, where it has a presence for over a hundred years. Asia has always been a part of Standard Charted's core business.

In Q3, Standard Charted reported a loss of US$139 million due to impairment costs amounting US$1,230 million. The majority of the impairment costs are loan related. That it a hefty write off and perhaps is a signal that all is not well in Asia.

Now, Standard Charted needs to raise additional capital amounting to US$5.1 billion and cut 15,000 jobs globally.

If anything, it goes to show that Asia could register more defaults in coming months, brought on by a strengthening US$, low commodity prices, and asset bubbles.

Read it all here: http://www.bloomberg.com/news/articles/2015-11-04/standard-chartered-s-bad-loans-reveal-cracks-in-asian-economies

In Q3, Standard Charted reported a loss of US$139 million due to impairment costs amounting US$1,230 million. The majority of the impairment costs are loan related. That it a hefty write off and perhaps is a signal that all is not well in Asia.

Now, Standard Charted needs to raise additional capital amounting to US$5.1 billion and cut 15,000 jobs globally.

If anything, it goes to show that Asia could register more defaults in coming months, brought on by a strengthening US$, low commodity prices, and asset bubbles.

Read it all here: http://www.bloomberg.com/news/articles/2015-11-04/standard-chartered-s-bad-loans-reveal-cracks-in-asian-economies

Subscribe to:

Posts (Atom)