From Bloomberg website

China has a huge debt problem, almost 300% of its GDP, over capacity in state owned heavy industries such as copper, aluminium and steel. Only as recently, it was reported in the news that many are asking the government to absorb their excess capacity. Several are in default of their debt obligations. Here are some examples in 2015:

1) Kaisa Group interest default (US$52M)

2) Baoding Tianwei Group Co interest default (85.8M Yuan)

3) Sinosteel default on 5.3% interest on 2B Yuan notes

4) Winsay Enterprises Holdings failed to meet interest payment on US$ notes for a second time this year

5) Yunan Coal Chemical Industry Group has 1.31B Yuan of overdue loans

6) Shanshui Cement announced on November 5 that it could default on its interest payment

I am expecting more defaults to come by early next year as manufacturing continues to contract. China's PMI has fallen below 50 for the past few months. 50 signals expansion while below 50 signals contraction. This is amidst a wave falling exports which crimped revenue in the manufacturing sector.

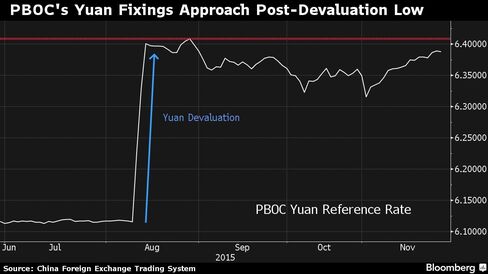

It is best to stay off any investment in China, and that include mainland Chinese stocks, bonds and currency. The worst is yet to come. If you should invest in China, go for companies listed in the US or HK instead, but only companies with very strong balance sheets.

No comments:

Post a Comment