It came as complete surprise as many had never expected the BOJ to go into negative interest rates. But what would be ramifications? Wall Street seemed to like it as the Dow soared almost 400 points. As an economist, Peter Boockvar puts it, Wall Street liked it a lot when the ECB and BOJ weaken their currencies vs the US$, but seemed to freak out that China would also want a weaker Yuan.

Surely the double standard could not have been more prevalent. Didn't the US devalue its currency when it went on a series of QEs? It's often easy to blame others for the failure of oneself.

Let's explore the ramifications in detail:

1) The way I see it, the BOJ's action changes nothing. The world is still mired in excessive debts, and the global economy is much worse than before. US GDP dropped to 0.7% in the fourth quarter. I would expect 2016 first quarter GDP to be no more stellar than the fourth had been. In fact, I think the first quarter of 2016 will see further distress in the manufacturing, mining and energy sectors. The energy sector could potentially see massive defaults by the shale oil companies, which in turn could unravel the financial derivatives market.

2) Japan's major problem is its diminishing population count. The labour force is shrinking and thus the consumption by the working class. The elderly who have retired consume less than the working class, having to rely only on their retirement funds for their livelihood for the remainder of their lives. And by announcing negative interest rates, the BOJ has certainly made life worse for the retirees as their savings will be impacted by the negative rates.

3) Despite the earlier QE and Abenomics, wage growth has not happened. Without wage growth, how can there be increase in consumption to drive inflation. It is the past decades of failure that is driving the Japanese to save more because the economy is weak. When the economy fails to create wealth, people will avoid spending. Hence the deflationary pressure.

4) The BOJ's action is akin to forcing inflation on the masses. But when there is no wealth creation, the population will just save more, not in the banks, but in their own homes and reduce spending as this form of forced inflation will just make goods and services more expensive. So I anticipate the deflationary pressures will increase after the feel good moment dissipates.

As Peter Boockvar puts it, "Believing that generating inflation is a needed precursor to faster economic growth is nonsense. Inflation reads are symptom of the activity of the underlying economy.

Source of Peter Boockvar's comment: King World News.

5) But didn't the BOJ's action resulted in a massive US rally? Big deal. Enjoy it while it lasts. As many economists would concur, the action of the BOJ has just unleashed a currency war in a race to the bottom. After the cheer is gone, the US will be faced with the stark reality that its goods and services have just been made more expensive by the strong US$, and this time the Fed will have to response with a possible QE4 with NIRP. The action of the BOJ has also open the gates for China to devalue its currency. Previously, China was trying to defend the Yuan, piling billions of US$ to defend it. The BOJ just has made it easy for China to abandon defending the Yuan, as now they could blame the BOJ for starting a currency war. This will snowball onto the rest of the EM economies, the result of which will be a global deflation.

Use of information contained in this blog does not constitute any contractual relationship between the reader and the author. The author hereby disclaims all responsibilities and liabilities for any use of information contained in this blog. Readers are advised to exercise due diligence and do their own assessment of the risks involved when investing in any company. Readers shall not hold the author liable for investments which have gone sour.

Saturday, January 30, 2016

Wednesday, January 27, 2016

MY EBOOK IS NOW AVAILABLE!

A new simplified version of my earlier book, "Your Personal Guide To Foreign Shares Investment" is now available in ebook format. Simply follow the link below.

This is from the perspective of a Malaysian.

http://www.bursaking.com.my/index.php/catalogs/view_item/Your-Personal-Guide-to-Foreign-Shares-Investment

This is from the perspective of a Malaysian.

http://www.bursaking.com.my/index.php/catalogs/view_item/Your-Personal-Guide-to-Foreign-Shares-Investment

Tuesday, January 26, 2016

THE FED AT NEAR BREAKING POINT?

This is a section of the Fed's Balance Sheet. look at the Total Liabilities vs Capital. The Fed is leveraged 112.6 to 1.0! Several months ago it was just 77.0 to 1.0!

The Fed is almost broke!

There is also an issue of US$19.5B being siphoned off its surplus. Apparently to fund spending after Congress and Senate reached an agreement on the budget (Source: King World News).

Sunday, January 24, 2016

WHY US DEBT IS NOT SUSTAINABLE

The following data are taken from www.usdebtclock.org which gives a live count of US debts and tax revenue.

Total US Debt: US$664.7T which include the Government, corporate and citizens debt.

Total US Government Debt: US$18.9T

Interest Paid on Federal Debt: US$0.23T

Total US Federal Spending: US$3.8T

Total US Federal Tax Revenue: US$3.3T

Total US Federal Deficit: US$0.5T

Total US Interest paid US2.4T

It is interesting to note that the Federal interest paid accounts for 7% of the tax revenue. With a budget deficit of US$0.5T a year, how can the US pay off any of its debt due in any of the years? So US has to take in more debts to repay older debts and this will add further to the burden in interest payments.

WSJ did a projection in interest payment in a report in February 2015, and it does not look good.

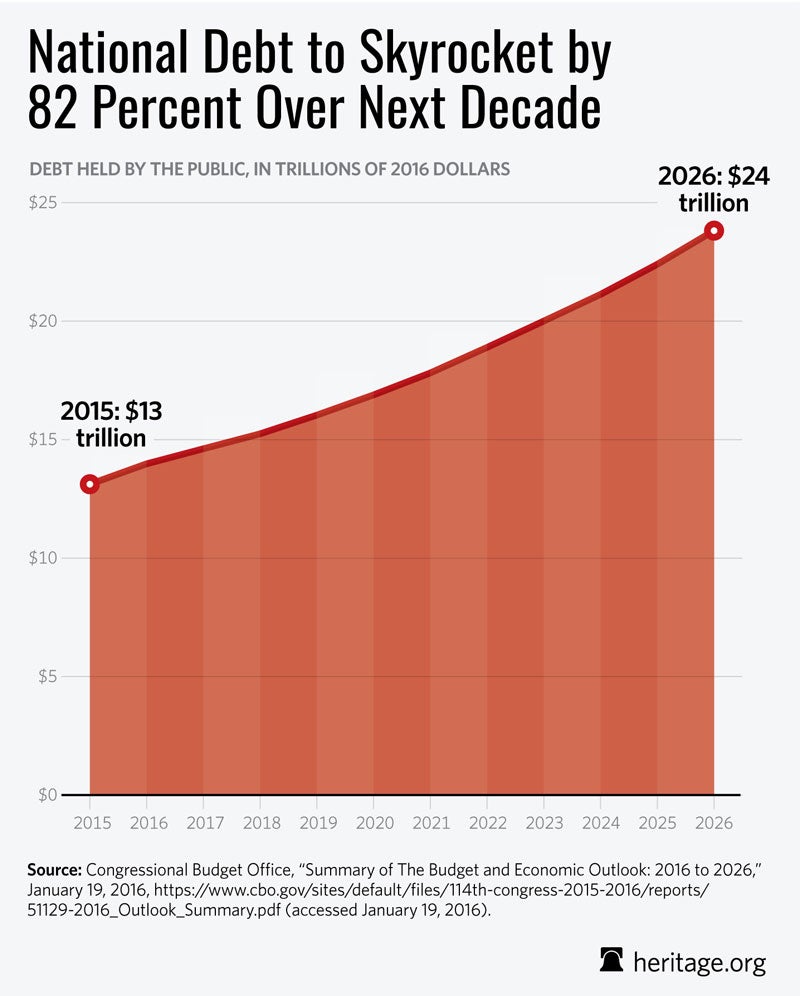

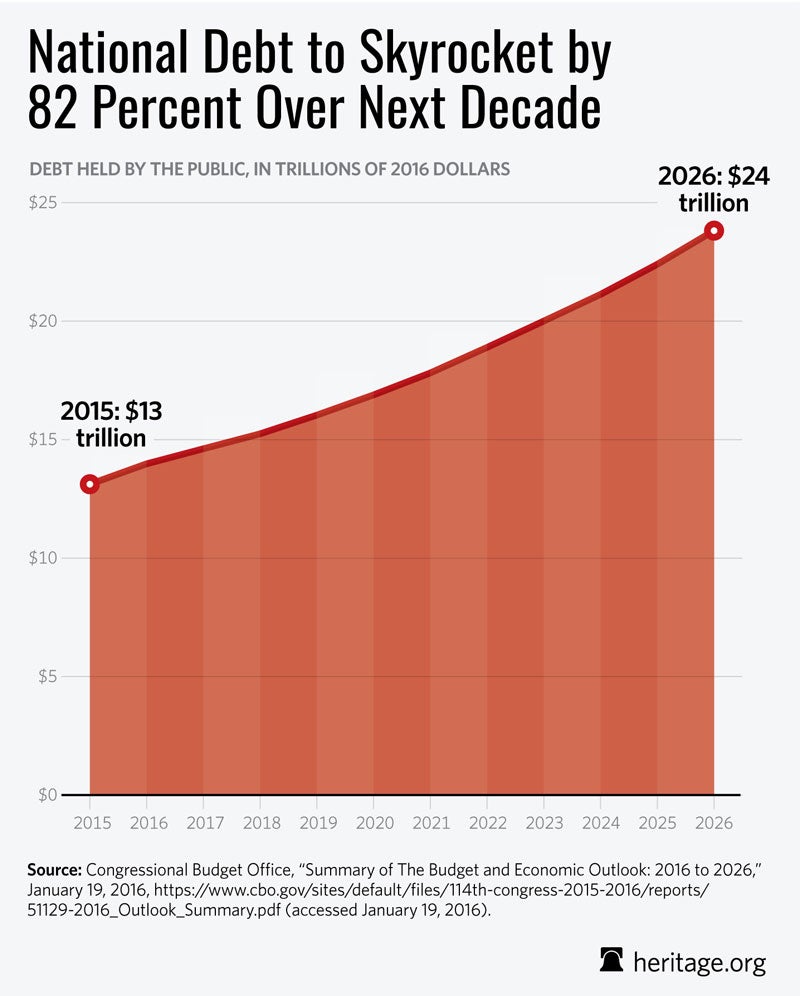

Another report by The Daily Signal shows the amount of debt accumulation by the US until 2026:

The above is based on a projection by the Congressional Budget Office.

However, should the economy suffers a slow down, tax revenue is bound to fall short. In such a scenario, the deficit could balloon to higher than projected. Similarly, any increase in interest rates will add to the burden of servicing the debts.

The US debt is clearly unsustainable. it is all just a matter of time when all come back to roost.

Total US Debt: US$664.7T which include the Government, corporate and citizens debt.

Total US Government Debt: US$18.9T

Interest Paid on Federal Debt: US$0.23T

Total US Federal Spending: US$3.8T

Total US Federal Tax Revenue: US$3.3T

Total US Federal Deficit: US$0.5T

Total US Interest paid US2.4T

It is interesting to note that the Federal interest paid accounts for 7% of the tax revenue. With a budget deficit of US$0.5T a year, how can the US pay off any of its debt due in any of the years? So US has to take in more debts to repay older debts and this will add further to the burden in interest payments.

WSJ did a projection in interest payment in a report in February 2015, and it does not look good.

Another report by The Daily Signal shows the amount of debt accumulation by the US until 2026:

The above is based on a projection by the Congressional Budget Office.

However, should the economy suffers a slow down, tax revenue is bound to fall short. In such a scenario, the deficit could balloon to higher than projected. Similarly, any increase in interest rates will add to the burden of servicing the debts.

The US debt is clearly unsustainable. it is all just a matter of time when all come back to roost.

Monday, January 18, 2016

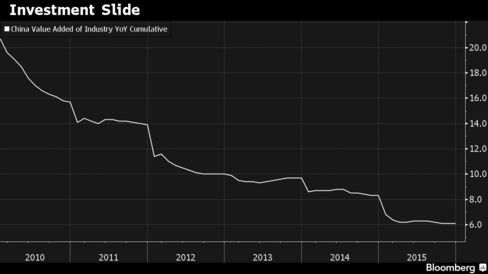

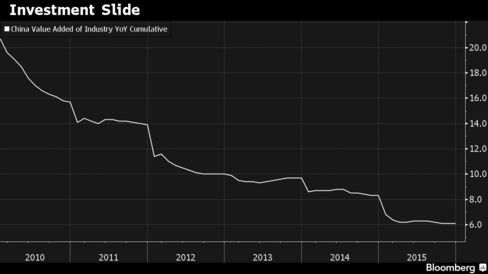

A HOST OF UNWELCOME DATA FROM CHINA

GDP 6.8% , 2015 full year GDP 6.9%, the lest since 1990.

Industrial Production in December 2015 grew 5.9% vs 2014. November 2015 was 6.2%.

Retail Sales grew 11.1% vs 11.3% estimate.

Fixed investment grew 10% in 2015, the slowest pace since 2000.

The chart (source: Bloomberg) below is cause for concern:

Industrial Production in December 2015 grew 5.9% vs 2014. November 2015 was 6.2%.

Retail Sales grew 11.1% vs 11.3% estimate.

Fixed investment grew 10% in 2015, the slowest pace since 2000.

The chart (source: Bloomberg) below is cause for concern:

WILL SHALE OIL DEFAULTS UNRAVEL THE BANKS?

With oil price hovering near the US$30 per barrel range, intense pressure has shifted towards the shale oil producers, once touted as the swing producers, the US shale oil companies are facing the potential collapse, wrought on by years of over leveraging and unabashed borrowings.

According to The Wall Street Journal, total debt among US and Canada oil producers amounted to US$353B for the period from 2010 - 2015.

Bloomberg recently compiled alist of shale oil producers and where they stand when it comes to their level of debts (source: Zerohedge and Bloomberg):

Notice that the size of the borrowing shave shrunk as banks moved into panic mode? With reduced borrowings and a falling price, it is doubtful these 25 companies listed above can survive past 2016. A falling demand for high yield junk bonds has not helped these companies either as investors shun high yield risky investments.

According to Fadel Gheit, a senior analyst at Oppenheimer & Co, one half of US shale oil producers will not survive the ongoing oil price plummet.

But what about the impact on banks.

So far, several banks have indicated that they will increase their provision for doubtful debts, chief among them:

Well Fargo, which reported a US$17B exposure on energy related loans and currently incurred a loss provision of US$1.2B in its energy related portfolio

BOK Financial Corporation advised its investors that it will be making aprovision for credit losses amounting to US$22.5M

JP Morgan too made similar provision amounting to US$89M.

So as shale oil companies face potential default, could banks be the next victim? We will know in a quarter or two.

I will be looking at a short financials ETF if more banks make further provisions for energy related credit losses.

The above is just my opinion. You advised to do your own due diligence.

According to The Wall Street Journal, total debt among US and Canada oil producers amounted to US$353B for the period from 2010 - 2015.

Bloomberg recently compiled alist of shale oil producers and where they stand when it comes to their level of debts (source: Zerohedge and Bloomberg):

Notice that the size of the borrowing shave shrunk as banks moved into panic mode? With reduced borrowings and a falling price, it is doubtful these 25 companies listed above can survive past 2016. A falling demand for high yield junk bonds has not helped these companies either as investors shun high yield risky investments.

According to Fadel Gheit, a senior analyst at Oppenheimer & Co, one half of US shale oil producers will not survive the ongoing oil price plummet.

But what about the impact on banks.

So far, several banks have indicated that they will increase their provision for doubtful debts, chief among them:

Well Fargo, which reported a US$17B exposure on energy related loans and currently incurred a loss provision of US$1.2B in its energy related portfolio

BOK Financial Corporation advised its investors that it will be making aprovision for credit losses amounting to US$22.5M

JP Morgan too made similar provision amounting to US$89M.

So as shale oil companies face potential default, could banks be the next victim? We will know in a quarter or two.

I will be looking at a short financials ETF if more banks make further provisions for energy related credit losses.

The above is just my opinion. You advised to do your own due diligence.

Sunday, January 17, 2016

CONSUMPTION COULD FALL NEXT?

Walmart to close 269 stores

Kmart to close 27 stores

JC penny to close 7 stores

Macy t close 35 stores

For those who still believe the US will hike interest rates this year, think again. This is a glaring telltale sign that the consumption driven economy in the US is going to fall off the cliff. Earlier I posted that the middle class in the US has shrunk more than 10% compared to the period in 2008 and the next worth is unchanged at the same level of the late 1980s. There is no wealth creation among the middle class in the US despite QE1-3!

The GDP to monetary base is yet another sign that all is not well in the US. When monetary base is enlarged but there is little or no wealth creation, it tells a very damaging story about the state of the US economy.

The Baltic Index gave the first hint when it started towards record new lows.

Buckle up. This is going to be a very tough year.

Thursday, January 14, 2016

COULD THE S&P FALL TO 550?

SocGen's Albert Edwards created a furore and thereafter much heated debate when he prognosticated that the S&P could fall as much as 75% to 550 due to China's devaluation.

My view: The S&P reached 683 in 2009. Since the Global Financial Crisis, global debt has increased 200% and global derivatives have increased anywhere from US$700T to US$1.5Q which is more than the US$500 plus T recorded in 2009.

US monetary base has increased 500% since then. GDP to monetary base is below that recorded during the Great Depression. During the 1997/98 Asia Financial Crisis, the US and EU were not as badly affected. In the 2008/2009 Global Financial Crisis, US and EU were badly hit, but Asia was able to power ahead though a debt fueled economy. Now the world is on the brink of yer another crisis and no major economy powerhouse is there to buffer any impact.

Currently the U6 data points to 10% unemployment. On the other hand, if we were to measure unemployment against the number of people within the employable age group, the unemployment could be close to 20%. That means 100 million Americans are without a job!

Today, we have a US economy that faces recession in earnings, recession in the oil, mining and manufacturing sectors. And now, US total debt stands at more than 300% of total GDP.

Look at the Blatic Index 402 points vs 12,000 points in 2008.

Any major crisis I believe, will be debt driven and in a deflationary economy, it could be a double whammy. Will the S&P really fall to 550? I do not know. If allowed in a freefall it could be worse than 2009. However, I am inclined to believe that the Fed will not allow the S&P to be in a freefall to 550. At 1,200 to 1,500, I think the Fed's printing press will work doubly hard, but will it be enough to stem the tide?

My view: The S&P reached 683 in 2009. Since the Global Financial Crisis, global debt has increased 200% and global derivatives have increased anywhere from US$700T to US$1.5Q which is more than the US$500 plus T recorded in 2009.

US monetary base has increased 500% since then. GDP to monetary base is below that recorded during the Great Depression. During the 1997/98 Asia Financial Crisis, the US and EU were not as badly affected. In the 2008/2009 Global Financial Crisis, US and EU were badly hit, but Asia was able to power ahead though a debt fueled economy. Now the world is on the brink of yer another crisis and no major economy powerhouse is there to buffer any impact.

Currently the U6 data points to 10% unemployment. On the other hand, if we were to measure unemployment against the number of people within the employable age group, the unemployment could be close to 20%. That means 100 million Americans are without a job!

Today, we have a US economy that faces recession in earnings, recession in the oil, mining and manufacturing sectors. And now, US total debt stands at more than 300% of total GDP.

Look at the Blatic Index 402 points vs 12,000 points in 2008.

Any major crisis I believe, will be debt driven and in a deflationary economy, it could be a double whammy. Will the S&P really fall to 550? I do not know. If allowed in a freefall it could be worse than 2009. However, I am inclined to believe that the Fed will not allow the S&P to be in a freefall to 550. At 1,200 to 1,500, I think the Fed's printing press will work doubly hard, but will it be enough to stem the tide?

IS THE PETRODOLLAR UNDER THREAT?

Many economists are projecting that saudi Arabia will likely depeg from the petrodollar to cover shortfalls in its budget which could amount to the tune of US$85B this year.

Will the depeg lead to further political tensions, and weaken the US$ hegemony in the oil trade, and worse, global trade?

Just yesterday news surfaced that come November 2016, oil could trade on the SPIMEX (St Petersburg International Mercantile Exchange) in Russian Roubles instead of US$. Just to recap, Russia is one of the larger buyers of gold. Does this mean that Russia has intention to back the Roubles with gold?

Russia is the world's largest oil producer, roughly a third of OPEC's production. Should this happen, it could impact upon the petrodollar hegemony as well.

Lastly, US GDP is expected to weaken as economic indicators are pointing to disappointing gorwth with some sectors being in recession (manufacturing, mining and oil). Even the S&P 500 earnings for Q4 is expected to be lower, then third month in negative territory. This will force the Fed's hand not to raise interest rates. As the results the US$ could weaken.

My own opinion? If two of the three conditions above are fulfilled, then we could see a weakended US$. Further upside if the Fed unleashes QE4 with negative interest rates (NIRP). Gold and silver could test historic highs.

.

Will the depeg lead to further political tensions, and weaken the US$ hegemony in the oil trade, and worse, global trade?

Just yesterday news surfaced that come November 2016, oil could trade on the SPIMEX (St Petersburg International Mercantile Exchange) in Russian Roubles instead of US$. Just to recap, Russia is one of the larger buyers of gold. Does this mean that Russia has intention to back the Roubles with gold?

Russia is the world's largest oil producer, roughly a third of OPEC's production. Should this happen, it could impact upon the petrodollar hegemony as well.

Lastly, US GDP is expected to weaken as economic indicators are pointing to disappointing gorwth with some sectors being in recession (manufacturing, mining and oil). Even the S&P 500 earnings for Q4 is expected to be lower, then third month in negative territory. This will force the Fed's hand not to raise interest rates. As the results the US$ could weaken.

My own opinion? If two of the three conditions above are fulfilled, then we could see a weakended US$. Further upside if the Fed unleashes QE4 with negative interest rates (NIRP). Gold and silver could test historic highs.

.

Sunday, January 10, 2016

CHINA'S GOLD AMBITION

The dotted lines are there. But the jigsaw pieces seem loose at the moment. These are the news:

1) China is the largest importer of gold and it is the world's largest gold miner. it is estimated that for more than a decade, China has mined 2,000 tonnes of gold and imported 3,000 tonnes of gold through Hong Kong. Yet China only declared it is holding 1,700 tonnes of gold.

2) The ICBC Bank (London) has been appointed by the BOE as the clearing house for Yuan in UK.

3) Recently, ICBC Bank is rumoured to be the buyer of Duetsche Bank's 1,500 tonnes gold vault in London, and could possibly include the 200 tonne gold vault in Singapore as Duetsche Bank exits the commodity trading business.

4) China has directed all foreign banks with import licence to participate in a Yuan denominated gold benchmark from April 2016 or face curbs in their gold import operations

London - Gold - Yuan. Some interesting developments could happen in the months ahead.

I remain bullish on physical gold and silver, gold and silver mining shares, gold and silver ETFs and gold and silver mining ETFs. Remember to always do your own research as our risk appetite often differs.

1) China is the largest importer of gold and it is the world's largest gold miner. it is estimated that for more than a decade, China has mined 2,000 tonnes of gold and imported 3,000 tonnes of gold through Hong Kong. Yet China only declared it is holding 1,700 tonnes of gold.

2) The ICBC Bank (London) has been appointed by the BOE as the clearing house for Yuan in UK.

3) Recently, ICBC Bank is rumoured to be the buyer of Duetsche Bank's 1,500 tonnes gold vault in London, and could possibly include the 200 tonne gold vault in Singapore as Duetsche Bank exits the commodity trading business.

4) China has directed all foreign banks with import licence to participate in a Yuan denominated gold benchmark from April 2016 or face curbs in their gold import operations

London - Gold - Yuan. Some interesting developments could happen in the months ahead.

I remain bullish on physical gold and silver, gold and silver mining shares, gold and silver ETFs and gold and silver mining ETFs. Remember to always do your own research as our risk appetite often differs.

Saturday, January 9, 2016

THE SIGNIFICANCE OF THE BALTIC INDEX CANNOT BE DOWNPLAYED

The significance of the data from the Baltic Index cannot be overlooked. The index measures dry bulk shipping, which means shipment of raw materials if the index falls, it means that less raw materials are being shipped across the globe. Here's what at stake:

1) Shipping companies will be hit hard. Ships are not cheap to build, and are heavily financed. So this could hit the banks too. As the index hovers at record low levels, heavy industries involved in the ship building industry will also be hit, that means more people being out of job which affect future consumption.

2) This leads to lower port activities, which impact upon the ports revenue. Ports are not cheap to build either. Like the ships, they are heavily financed and could hit the banks too. In, fact Maersk reported that they are also shipping less container goods compared to previous years. Look at the US and China export and import data which confirm Maersk's report.

3) Low shipment of raw materials means poor manufacturing. Poor manufacturing is due to poor consumption. This is reflected in the US and China ISM and PMI manufacturing data which have all fallen to disturbing levels. In fact, manufacturing is in recession in both the US and China.That means more people are out of job in the manufacturing sector, which affects future consumption

4) Lesser raw materials shipped means demand for commodities is low. That means agriculture, mining and resource industries are facing tremendous headwinds. All these industries are in deep recession; for example copper, iron ore, coal, precious metals and oil to name a few. Many employees int his sector have been laid off, again this affects future consumption.

Since many of these companies are laden with debts, expect many more debts to be rated junk, and more defaults in the months ahead. There will be a continuation in sell off of high yielding junk bonds, which leads to putting banks at risk. Think Glencore and Noble.

5) Most, if not all of the people who lost their jobs have personal debts of their own. Without a job how can they pay their debts? While the debt per se is inconsequential, taken as a whole when millions are without a job, and multiply it with tens of thousands of dollars in debts, you can guess the impact.

This is a vicious circle which will continue to turn until it exhausts itself.

The record low Baltic Index is not a small blip on the radar screen, it is an explosion that has just erupted on the radar screen.

1) Shipping companies will be hit hard. Ships are not cheap to build, and are heavily financed. So this could hit the banks too. As the index hovers at record low levels, heavy industries involved in the ship building industry will also be hit, that means more people being out of job which affect future consumption.

2) This leads to lower port activities, which impact upon the ports revenue. Ports are not cheap to build either. Like the ships, they are heavily financed and could hit the banks too. In, fact Maersk reported that they are also shipping less container goods compared to previous years. Look at the US and China export and import data which confirm Maersk's report.

3) Low shipment of raw materials means poor manufacturing. Poor manufacturing is due to poor consumption. This is reflected in the US and China ISM and PMI manufacturing data which have all fallen to disturbing levels. In fact, manufacturing is in recession in both the US and China.That means more people are out of job in the manufacturing sector, which affects future consumption

4) Lesser raw materials shipped means demand for commodities is low. That means agriculture, mining and resource industries are facing tremendous headwinds. All these industries are in deep recession; for example copper, iron ore, coal, precious metals and oil to name a few. Many employees int his sector have been laid off, again this affects future consumption.

Since many of these companies are laden with debts, expect many more debts to be rated junk, and more defaults in the months ahead. There will be a continuation in sell off of high yielding junk bonds, which leads to putting banks at risk. Think Glencore and Noble.

5) Most, if not all of the people who lost their jobs have personal debts of their own. Without a job how can they pay their debts? While the debt per se is inconsequential, taken as a whole when millions are without a job, and multiply it with tens of thousands of dollars in debts, you can guess the impact.

This is a vicious circle which will continue to turn until it exhausts itself.

The record low Baltic Index is not a small blip on the radar screen, it is an explosion that has just erupted on the radar screen.

Thursday, January 7, 2016

SPECULATION RIFE THAT SAUDI ARABIA'S RIYAL COULD DEPEG FROM US$

Speculation is rife that Saudi Arabia (SA) will depeg the Riyal from the US$ as oil price continues it freefall. This is a chart from the zerohedge.com which projected the amount of debt SA needs to borrow to buffer its budget shortfall:

SA is presently confronted with crises on several fronts:

1) The price of oil which has fallen to less than US34 per barrel. With so much reliance on oil, this has put a strain on its budget

2) Proxy war in the Middle East. This too is putting a stress on SA's finances. The war is expected to last longer as special interest groups take sides

3) SA posted a US$98B budget deficit in 2015 and projected another US$87B budget deficit in 2016. SA needs to cut down its social programmes in order to rein in the budget deficit but that would mean raising discontent among its citizens. Therefore, this subject is often threaded with caution.

One idea mooted by economists is to depeg the Riyal from the US$, and so allowing SA the much needed breathing space.

But what would be the impact globally? A depeg of the Riyal from the US$ could threaten the Petrodollar, and thus the world could see a potential collapse of the hegemony of the Petrodollar.

The above are just my opinion.

SA is presently confronted with crises on several fronts:

1) The price of oil which has fallen to less than US34 per barrel. With so much reliance on oil, this has put a strain on its budget

2) Proxy war in the Middle East. This too is putting a stress on SA's finances. The war is expected to last longer as special interest groups take sides

3) SA posted a US$98B budget deficit in 2015 and projected another US$87B budget deficit in 2016. SA needs to cut down its social programmes in order to rein in the budget deficit but that would mean raising discontent among its citizens. Therefore, this subject is often threaded with caution.

One idea mooted by economists is to depeg the Riyal from the US$, and so allowing SA the much needed breathing space.

But what would be the impact globally? A depeg of the Riyal from the US$ could threaten the Petrodollar, and thus the world could see a potential collapse of the hegemony of the Petrodollar.

The above are just my opinion.

DOW FELL 392 TO 16,514

The Dow ended down 392 points last night.

Whatever that comes out on the Friday Jobs Report has no significance. The Fed still thinks the economy in on a solid path which is pretty amusing, considering that the U6 unemployment data which includes the number of people who have left employment on their own accord or have become disillusioned in finding a job is 10%. Even scarier, if one takes unemployment to include everyone of employable age, the unemployment is closer to 20%. But the Fed still prefer to adopt the feel good rate of 5%.

High paying manufacturing jobs are being substituted by low paying service industry jobs and part time jobs. US manufacturing is already in recession. The shale oil industry is collapsing under its own weight of debts, made worse by the plunging oil price. Even banks are laying off employees. The holiday season in December has ended, and with it many part time jobs. I expect jobs to fall in the coming months as the global economy becomes much, much worse than many were led to believe.

The Fed must be quite ignorant too. How can the US be on solid footing when the best global trade indicator of all, the Baltic Index has fallen to record lows. If anything it coincides with the data that US manufacturing is in recession.

I am inclined to believe that the Fed move to raise interest rates was a face saving move, a false conviction that QE1-3 was a success.

The above is just my opinion.

Whatever that comes out on the Friday Jobs Report has no significance. The Fed still thinks the economy in on a solid path which is pretty amusing, considering that the U6 unemployment data which includes the number of people who have left employment on their own accord or have become disillusioned in finding a job is 10%. Even scarier, if one takes unemployment to include everyone of employable age, the unemployment is closer to 20%. But the Fed still prefer to adopt the feel good rate of 5%.

High paying manufacturing jobs are being substituted by low paying service industry jobs and part time jobs. US manufacturing is already in recession. The shale oil industry is collapsing under its own weight of debts, made worse by the plunging oil price. Even banks are laying off employees. The holiday season in December has ended, and with it many part time jobs. I expect jobs to fall in the coming months as the global economy becomes much, much worse than many were led to believe.

The Fed must be quite ignorant too. How can the US be on solid footing when the best global trade indicator of all, the Baltic Index has fallen to record lows. If anything it coincides with the data that US manufacturing is in recession.

I am inclined to believe that the Fed move to raise interest rates was a face saving move, a false conviction that QE1-3 was a success.

The above is just my opinion.

Subscribe to:

Posts (Atom)