Total US Debt: US$664.7T which include the Government, corporate and citizens debt.

Total US Government Debt: US$18.9T

Interest Paid on Federal Debt: US$0.23T

Total US Federal Spending: US$3.8T

Total US Federal Tax Revenue: US$3.3T

Total US Federal Deficit: US$0.5T

Total US Interest paid US2.4T

It is interesting to note that the Federal interest paid accounts for 7% of the tax revenue. With a budget deficit of US$0.5T a year, how can the US pay off any of its debt due in any of the years? So US has to take in more debts to repay older debts and this will add further to the burden in interest payments.

WSJ did a projection in interest payment in a report in February 2015, and it does not look good.

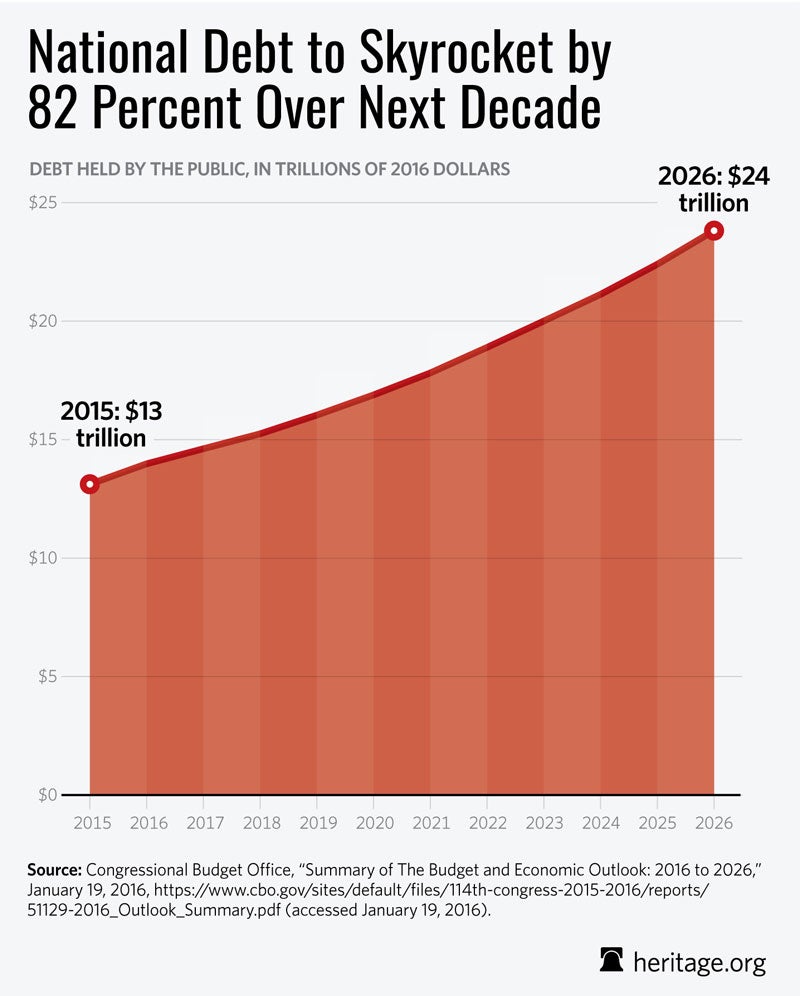

Another report by The Daily Signal shows the amount of debt accumulation by the US until 2026:

The above is based on a projection by the Congressional Budget Office.

However, should the economy suffers a slow down, tax revenue is bound to fall short. In such a scenario, the deficit could balloon to higher than projected. Similarly, any increase in interest rates will add to the burden of servicing the debts.

The US debt is clearly unsustainable. it is all just a matter of time when all come back to roost.

No comments:

Post a Comment